Two officials from Ecopetrol and one from the UIS Alliance are part of the eight Colombians certified in the organic petrography technique.

Equion’s oil proyect in Nuchía was stopped after legal actions against the company were submitted by a local lawyer, and protests in Tauramena against Ecopetrol (NYSE:EC) do not seem to stop. However, GeoPark (NYSE: GPRK) and Parex (TSX: PXT) showed their commitment to the Tauramena community and carried out a medical brigade in the area. These and other Corporate Social Responsibility (CSR) projects in our periodic summary.

The oil company started operating the Llanos block 34 in the department of Casanare five years ago. GeoPark (NYSE: GPRK) created a strategy under the principle of “create value”.

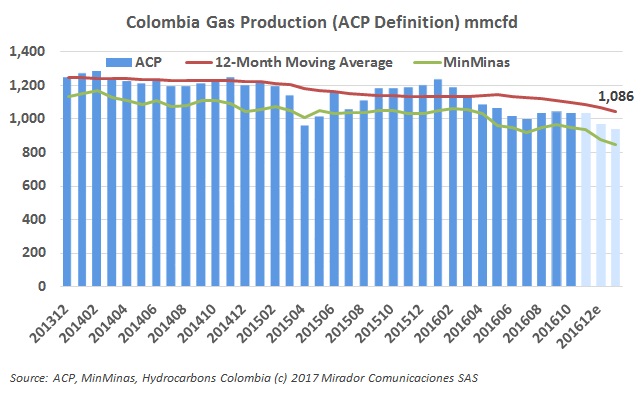

GasAlmost at ‘the last possible moment, MinMinas finally published production numbers for January 2016. While crude oil went up, natural gas continued to slide. Although some companies are increasing their production, there is not much reason for optimism at the national level.

The Colombian Chamber of Petroleum Goods and Services (Campetrol) is optimistic about this year. The association believes that oil activity and investment will recover. Campetrol’s optimism is based on an analysis by the Colombian Petroleum Association (ACP).

The National Planning Department (DNP) initiated a process to modernize the Planes de Ordenamiento Territorial (POT) in the country. Many municipalities with oil activity are part of this process and must adjust to the new rules.

USO reported their health and education rights are being supposedly violated by Ecopetrol (NYSE:EC.) The Union said drastic measures would have to be taken if the NOC does not agree to negotiate with them.

Crudo Transparente is a non-governmental organization that “informs, socializes and analyzes the socio-economic impacts of the hydrocarbons sector in the country”.

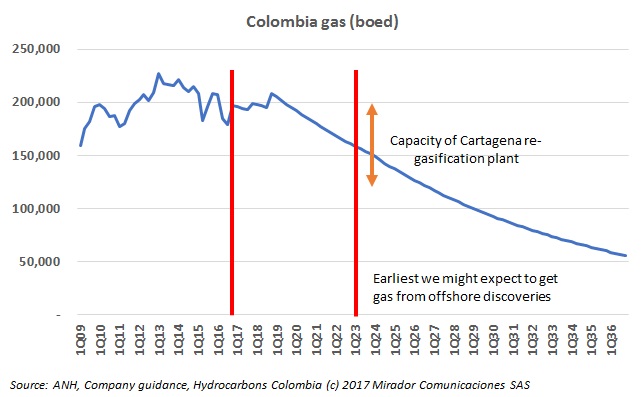

We needed to build a simple gas forecast for a few fields for a consulting project so we decided to build a model of the Colombian market. The results were interesting even with these simple assumptions.

Through the Oil Development Program (OFD), the Norwegian Agency for Development and Cooperation (NORAD) aims to provide assistance to developing countries that want to manage oil resources in a sustainable way. Colombia is currently benefiting from the project.