GasOrlando Cabrales, President of Naturgas, said that the sector’s offshore plans for this year are historical for the country. The industry is optimistic about the possible results of these projects.

The sector is investing in oil transportation infrastructure in the country. The industry is betting on transporting at least some of the crude through the Magdalena River.

Earlier this week, ELN said actions needed to be taken soon to reduce the intensity of the conflict. However, the guerrilla’s actions are showing the opposite of what they say they want.

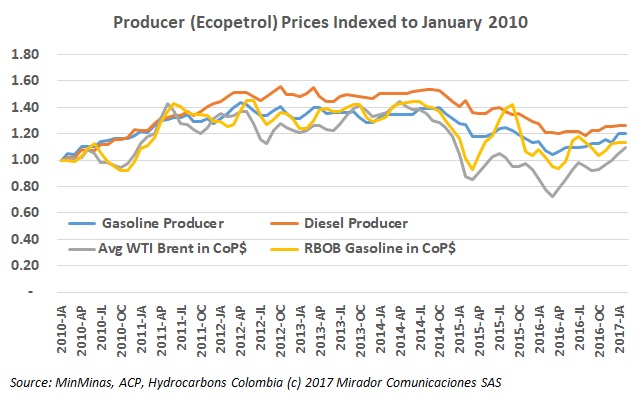

The graph shows fuel producer prices – what Ecopetrol (NYSE:EC) receives – which are unaffected by the so-called “Green Tax”. We think the graph shows Colombians are still paying too much although the gap has reduced somewhat.

Germán Castro, Executive Director of the Energy and Gas Regulatory Commission (CREG) spoke about regasification plants in Colombia, the government’s priorities and the sector’s perspectives on this.

Alejandro Martínez Villegas, President of the propane distribution association (Gasnova), is optimistic about the future of propane in the country. He mentioned that the construction of the new plant in Cartagena is vital to guarantee supply.

Apparently, everyone has an idea to modify the National General System of Royalties (SGR.) Projects to assign the budget required to re construct Mocoa and to allow the territorial National Pension Funds (FONPETs) to use their spare budget in social investment programs. These and other stories in our periodic Royalties summary

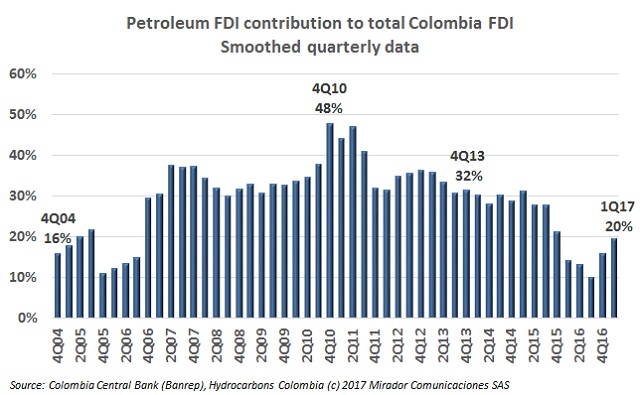

Colombia’s Central Bank released 1Q17 Foreign Direct Investment (FDI) numbers for the country and it decreased in the oil sector.

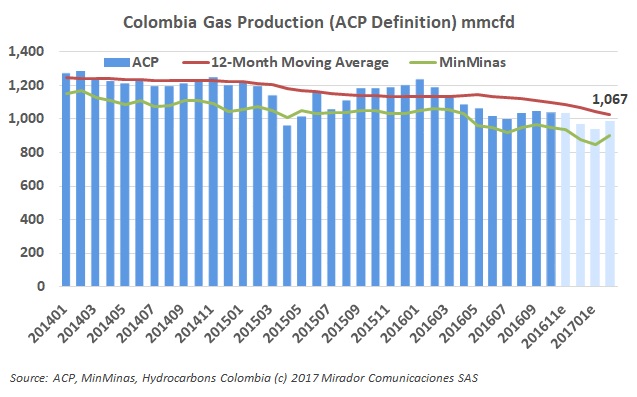

GasFelipe Bayón, COO of Ecopetrol (NYSE: EC) talked about gas prospects in Colombia. Oil is the most important resource today, but gas will increase its participation in the country’s production in coming years.