Once again, Gran Tierra (TSX:GTE) has been forced to suspend activities at El Porton in Yopal, Casanare because of community concerns about environmental impact, despite the ANLA’s support for the company’s license.

USO has been leading protests against Ecopetrol’s (NYSE:EC) management decisions. The Union joined Catatumbo’s mobilizations, blocked Barrancabermeja’s refinery entrance and stopped activities atthe San Fernando Station.

Francisco Lloreda, president of the Colombian Petroleum Association (ACP) questioned the current General System of Royalties (SGR.)

Juan Manuel Santos, President of Colombia and German Arce Zapata, MinMinas, visited the Siluro-1 well drilled by Repsol (MSE: REP). They highlighted their commitment to the offshore industry in Colombia.

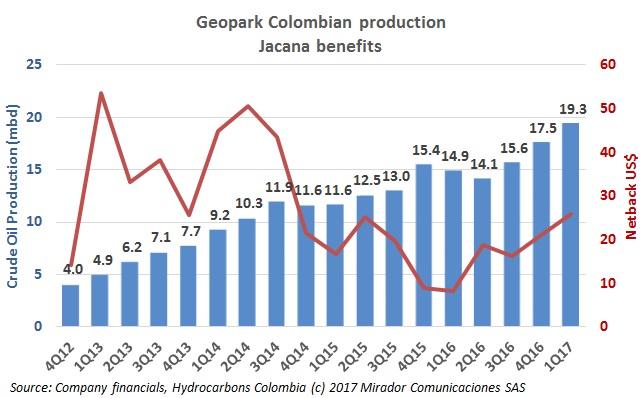

Geopark (NYSE: GPRK) reported its financial results for 1Q17 and the firm´s showed good financial and operational performance during this quarter. The company achieved record consolidated oil and gas production.

A wave of violent attacks has been reported throughout the country, in the middle of the peace talks between ELN and the government, and at the beginning of the post-conflict process with FARC.

The Ministry of Mines and Energy (MinMinas), the Superintendency of Public and Residential Services, the Energy Regulatory Commission (CREG) and Palacios y Lleras law firm hosted the “Future of Energy in Colombia” forum at Javeriana University. HCC attended the event.

Because fuel smuggling has turned into a big problem in Santander, local authorities have been forced to double surveillance and operatives in the department to control it. The development of these and other stories in our periodic Security Summary.

Ecopetrol (NYSE: EC) has reported good financial performance, despite low prices and less production. The company announced that it has cash to buy oil reserves abroad.

The National Planning Department (DNP) made the recommendation to the mining and oil municipalities of the country.