Colombia has many offshore projects to develop in coming years. Companies are preparing and Barranquilla as well.

The Coveñas / Caño Limón pipeline, one of the main assets of the country to transport crude, continues to report problems from attacks and this is generating huge losses. Ecopetrol (NYSE: EC) commented on the status of this important pipeline.

The Colombian Association of Petroleum Engineers (Acipet) said that if the ‘No’ wins in Pasca (Cundinamarca,) fuel and ACPM transport through tanker trucks could be banned from the municipality.

Ecopetrol (NYSE: EC,) Equión and Ocensa reported on their commitment to the communities of their areas of influence and announced their most recent projects. These and other Corporate Social Responsibility (CSR) stories in our periodic summary.

With the new ruling, the Government would not alter the mechanism of citizen participation, but would seek to integrate it to the development of extractive projects.

The National Government asked La Guajira’s authorities to be accountable for the projects that are being financed in the department with the royalties’ budget, but they failed to comply with this demand. These and other stories in our Royalties periodic summary.

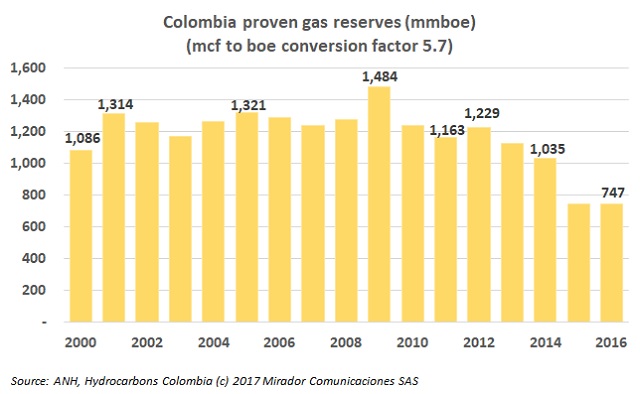

Colombian oil industry has announced gas discoveries in the Caribbean Sea recently. It increased reserves and several experts are talking about this topic.

There has been much discussion about the Barrancabermeja refinery’s future. Some have said that Ecopetrol (NYSE: EC) will close it, but the company has denied that. Juan Carlos Echeverry, CEO of ECP talked about the refinery situation and his perspectives in an interview with El Espectador.

Colombian authorities have been working to boost the oil sector and they have high expectations for offshore projects. There was no clear and complete regulation for the offshore industry but now Ministry of Mines (MinMinas) just published signed one into law.

The offshore potential in the Caribbean Sea are raising expectations in the Colombian coast. Many municipalities and departments are working to attract companies to their territories.