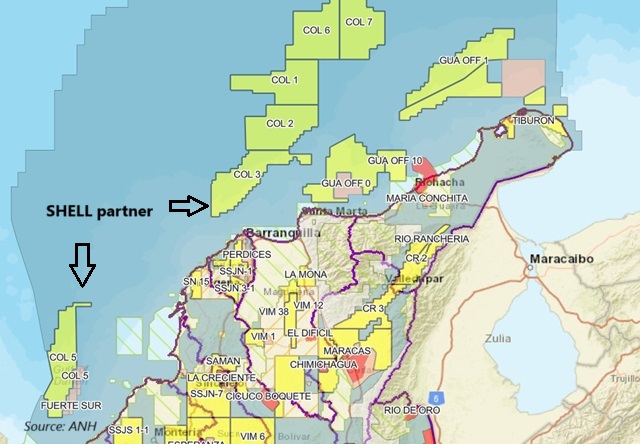

British energy giant Shell (LON: RDSB) is divesting its participation in several Colombian oil and gas blocks, effectively marking its exit from the country’s hydrocarbon exploration and production sector.

Rodrigo Costa, General Manager of Petrobras Colombia, talked about the expectations about the Sirius-2 well.

Manuel Peña Suárez, an electrical engineer with a master’s degree in economics, has been appointed as the acting director of Colombia’s Mining and Energy Planning Unit (UPME), replacing Carlos Adrián Correa.

As Latin America faces a turbulent global economic environment in 2025, its persistent fiscal challenges are pushing the region to reevaluate how public finances are managed.

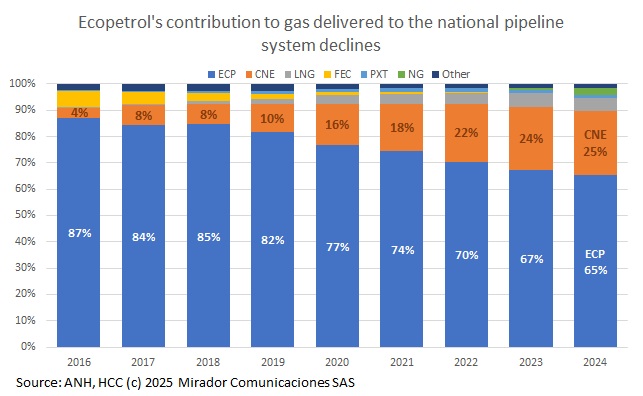

Despite recent statements by President Gustavo Petro suggesting that natural gas prices should remain low, Ricardo Roa Barragán, President of Ecopetrol (NYSE: EC), delivered a more sobering message.

Colombia’s National Environmental Licensing Authority (ANLA) launched a formal sanctioning process against Canadian oil companies Canacol Energy (TSX: CNE) and Carrao Energy, citing multiple environmental violations related to their operations in Block Llanos 23, located in San Luis de Palenque, Casanare.

Cenit, a subsidiary of Grupo Ecopetrol, activated its Emergency and Contingency Plan (PEC) following a loss of containment on the Coveñas Caño Limón (CCL) oil pipeline.

Colombia’s Superintendence of Public Services (SuperServicios) is collecting evidence to potentially sanction natural gas distributor Vanti over recent tariff hikes.

At the closing session of the Naturgas Congress held in Barranquilla, Juan Manuel Rojas, Chairman of the Board of Directors of Naturgas and CEO of Promigas, highlighted the critical situation facing Colombia’s natural gas industry.

Luz Stella Murgas, President of Naturgas, laid bare the consequences of Colombia’s energy policy decisions and offered a clear roadmap to restoring natural gas self-sufficiency.