The ELN guerrilla has launched many attacks against the oil infrastructure. The peace process with this guerrilla is progressing and the sector is benefiting greatly from this.

Last week, the oil sector welcomed the announcement by the government and the ELN to agree on a bilateral ceasefire. USO spoke about this subject.

Representatives of the oil sector met with the President of Colombia Juan Manuel Santos and senior government officials to talk about the industry.

The National Environmental Licensing Authority (ANLA) hosted a public hearing to discuss the proposal for exploratory activities in the Marteja area, which has influence on the municipalities of San Vicente de Chucurí, Barrancabermeja and El Carmen de Chucurí (Santander).

Attacks to oil infrastructure in Norte de Santander have contaminated nine local water sources and even affected the Magdalena River. The development of these and more stories in our periodic Eco summary.

Detractors and defenders of fracking gave their opinion on this technique in afact-based debate.

The Alianza Colombia Libre de Fracking (ACLF) made a complaint against ConocoPhillips (NYSE: COP), saying the company is carrying out fracking activities.

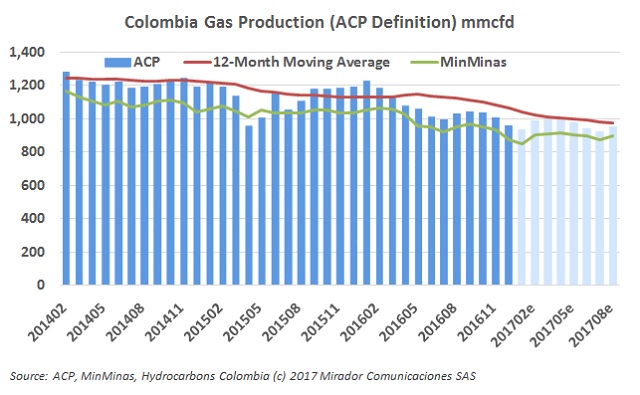

GasThe Energy Regulatory Commission (CREG) announced changes in the natural gas wholesale market and these adjustments will take effect from this year.

The National Army presented a positive report on operations to fight this crime in the departments of Arauca, Norte de Santander and Nariño. The development of these and other stories in our periodic Security summary.

ProductionAlleged breaches of the environmental management plan is why the Inspector General ordered to stop activities in this important asset of Ecopetrol (NYSE: EC).