The Colombian oil sector had a difficult year as a result of social and legal problems. The country will have elections in 2018 and the industry is concerned about the results of this process.

German Arce, Minister of Mines and Energy (MinMinas), spoke about the possibility of implementing unconventional techniques and the consequences if these are not approved.

The Police and the Army committed to reinforce surveillance activities on the border between La Guajira and Venezuela, with the aim of controllingsmuggled fuel that arrives from the neighboring country. The development of these and other stories in our periodic Security summary.

The president of the National Hydrocarbons Agency (ANH), Orlando Velandia, spoke about how fracking is progressing in the country and reiterated the need to understand that a big part of the national economy depends on the industry.

The government has great hopes for offshore projects to guarantee the country’s energy self-sufficiency in the long term. Authorities have created several regulatory standards to promote the development of these new projects.

Security and Public OrderThe union said that its fight against fracking is just beginning and that together with communities; they have managed to delay the pilot project in San Martín (César).

The National Hydrocarbons Agency (ANH) hosted its 2017 accountability session in Bogotá and HCC attended the event. According to the entity’s president, Colombia is an international benchmark in oil matters.

A few weeks ago, we published a story about Barranquilla becoming a member of the World Energy Cities Partnership (WECP). I could not resist the temptation to make an ironic comment about being an ‘energy city’ without having produced a drop of oil.

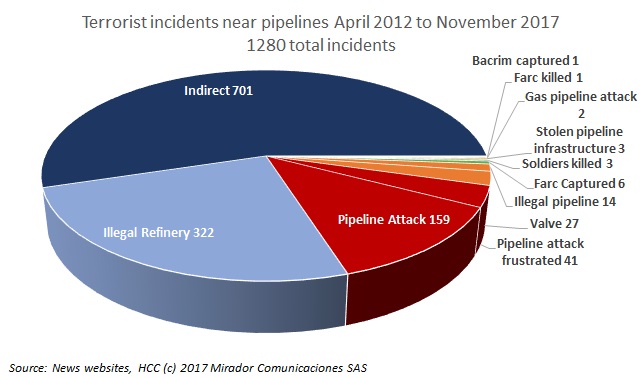

We decided to take a fresh look at our tracking of security incidents near pipelines to make the analysis easier and ensure we were being consistent in our classifications.

According to a report from the Colombian Petroleum Association (ACP), companies invested US$3.4M in the country during 2017.