President Gustavo Petro has publicly dismissed concerns about a potential financial crisis at Ecopetrol (NYSE: EC) emphasizing that the firm remains stable despite external pressures from falling global oil prices.

Colombia could be forced to rely permanently on oil and gas imports if the current government policies under President Gustavo Petro are not reversed, according to a stark warning from the national Comptroller General’s Office.

According to the latest Latam Pulse report released by Bloomberg and AtlasIntel, Colombia ranks as the second-most politically risky country among key Latin American economies and also holds the second-lowest presidential approval rating in the region.

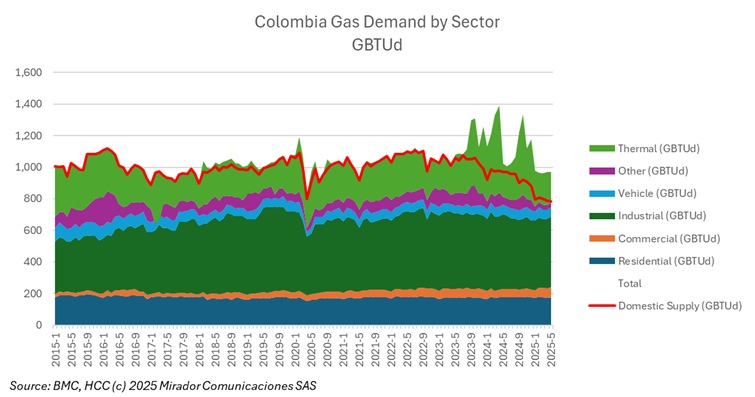

Colombia will need to keep importing natural gas in 2026 to meet domestic demand, according to figures from the country’s Gas Market Operator.

President Gustavo Petro has once again urged Ecopetrol (NYSE: EC) to sell its fracking operations in the US.

GeoPark (NYSE: GPRK) enacted a limited-duration shareholder rights plan following a swift stock accumulation by a single investor. The move aims to protect the company’s shareholder value and prevent any one entity from gaining excessive control.

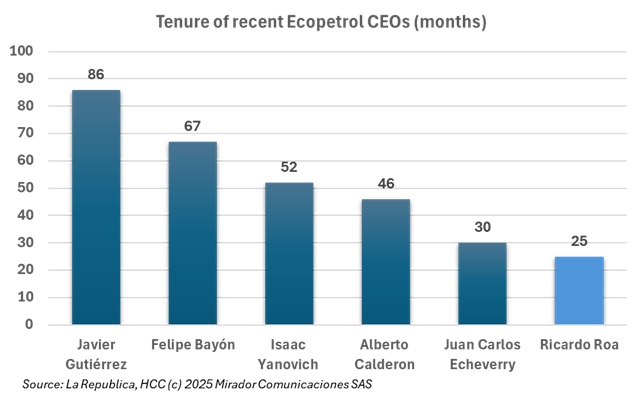

The presidency of Ricardo Roa at Ecopetrol (NYSE: EC) is facing intensifying scrutiny as corruption allegations continue to mount.

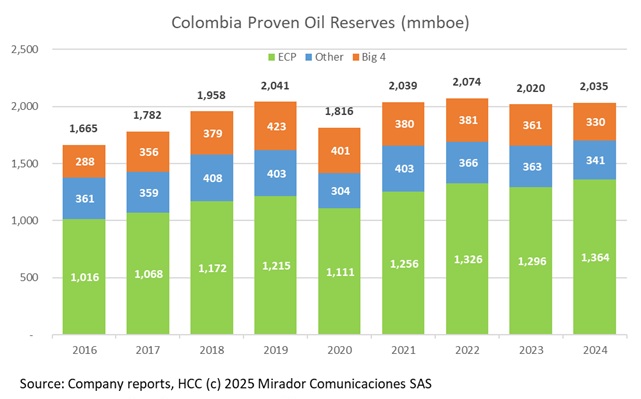

We cannot really blame Orlando Velandia and the ANH for spin-doctoring the recent oil and gas reserves report. His ultimate boss, Colombian President Gustavo Petro, doesn’t need any more bad press. But second derivatives, while interesting, do not tell the story.

As speculation grows over the possible resignation of Ecopetrol’s (NYSE: EC) current CEO, Ricardo Roa, a historical pattern emerges as since 1998, the average tenure of an Ecopetrol president has been 51 months.

Colombia has been ranked as the fifth most complex country in the world to do business, according to the 2025 Global Business Complexity Index released by TMF Group. The list is led by Greece, followed by France, Mexico, Turkey, and then Colombia.