Despite ongoing local and global uncertainty, Colombia’s economy continues to show encouraging signs of recovery.

Ecopetrol (NYSE: EC) and the Unión Sindical Obrera (USO) have sealed a strategic agreement to advance the Fuel Quality Baseline Project, a landmark initiative aimed at producing fuels that meet the highest international standards, lowering CO₂ and sulfur emissions, boosting the petrochemical industry, and contributing to Colombia’s energy transition.

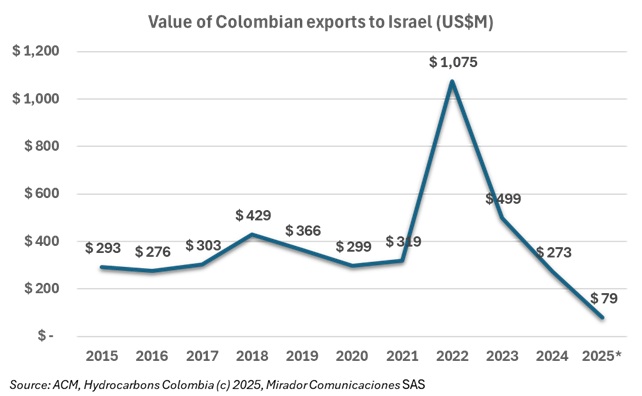

During the meeting of energy ministers of the Community of Latin American and Caribbean States (CELAC), Colombian President Gustavo Petro urged the Wayúu communities to halt attempts by Glencore, Cerrejón, and Drummond to export coal to Israel.

During his visit to Monómeros’ headquarters to review the company’s financial statements, infrastructure, and the working conditions of its 522 direct employees and nearly 1,200 indirect workers, Colombia’s Minister of Mines and Energy (MinEnergia), Edwin Palma, praised the company’s resilience and strong performance despite the significant challenges it faces.

Empresas Públicas de Medellín (EPM) announced a financial incentive of up to CoP$2.0M for the installation of Natural Gas Vehicle (NGV) equipment.

Ecopetrol (NYSE: EC) is facing a corporate and legal storm that could have international repercussions.

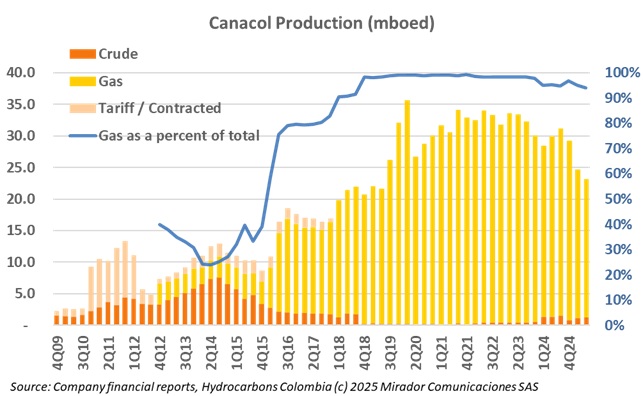

Canacol Energy (TSX: CNE) announced its financial and operational results for the three months ending June 30th, 2025.

Colombia’s traditional export landscape is undergoing a quiet transformation. For the first five months of 2025, remittances from Colombians abroad nearly equaled revenues from oil exports—once the country’s dominant source of foreign currency.

Ahead of its second-quarter 2025 earnings release, Ecopetrol (NYSE: EC) President Ricardo Roa announced that the company achieved its highest oil production in the last ten years.

President Gustavo Petro announced that the government had reached an agreement to end the mining strike in Colombia, following a series of negotiations that produced key commitments for the sector.