The Colombian Chamber of Goods and Services (Campetrol) reported rig information for August 2025.

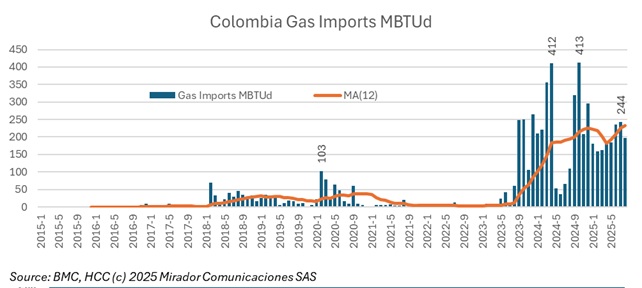

Six new prior consultations have emerged as the main threat to Petrobras’ (NYSE: PBR) ambitious plan to begin natural gas production from the offshore Sirius field before 2030. The company warns that regulatory uncertainty could delay Colombia’s return to energy self-sufficiency.

GeoPark Limited (NYSE: GPRK) has taken a major step into Argentina’s world-class Vaca Muerta formation with the purchase of two key blocks from Pluspetrol for US$115M.

Ecopetrol (NYSE: EC) successfully completed a pilot project to produce industrial bicarbonate using captured carbon dioxide (CO₂), marking a new milestone in its strategy to reduce greenhouse gas emissions and support Colombia’s energy transition.

Earlier this month the Colombian-Canadian Chamber of Commerce held its annual Dialogo Canada day, an event that discusses Colombian policy topics of interest to the major Canadian investment groups in the country. The session on hydrocarbons featured a discussion between Orlando Velandia, president of the industry regulator, the ANH, and two industry representatives, Gran Tierra’s Country Manager, Diego Perez-Claramunt and Parex’s Government Affairs VP, Rafael Pinto.

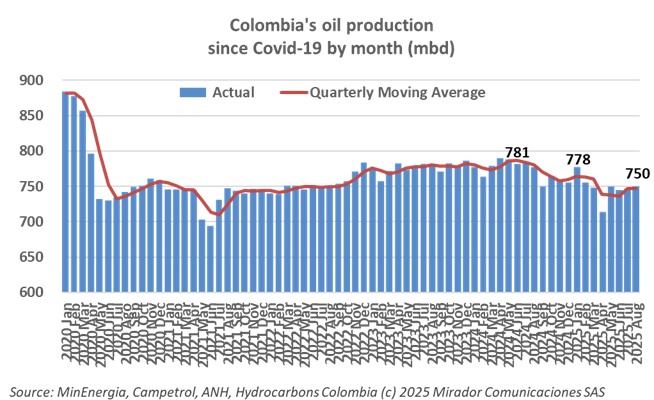

Colombia’s oil production slipped again in August 2025, underscoring the dual pressures of social unrest and aging fields on the country’s most important export sector.

Colombia’s Senate is set to debate a new proposal, Bill 247 of 2025, that would overhaul the rules for importing and marketing natural gas.

The latest Pulso Eléctrico 2025 survey, conducted by Arteaga Latam, has confirmed overwhelming public support for renewable energy in Colombia, with solar and wind emerging as the clear favorites for expansion.

Terpel has officially taken control of Parque Solar Planeta Rica, becoming the parent company of the 26.6-megawatt solar plant after receiving regulatory approval for the acquisition.

Ecopetrol (NYSE: EC) confirmed a major step forward in Colombia’s efforts to secure new gas supplies: its contractor Regasificadora del Pacífico S.A.S. signed an agreement with Belgian shipping company Exmar for a floating storage unit (FSU) in Buenaventura.