Ecopetrol (NYSE: EC) secured a key milestone in its gas-supply strategy after Colombia’s environmental licensing agency, ANLA, approved the company’s plan to import natural gas through Cenit’s infrastructure in Coveñas.

The Colombian Chamber of Goods and Services (Campetrol) reported rig information for October 2025.

Colombia’s vehicular natural gas (VNG) market is heading toward one of its most turbulent moments in decades. Beginning December 1, prices are set to rise sharply, between 30% and 40% according to industry estimates, marking a turning point for drivers, transport companies, and fuel distributors across the country.

During the second day of the VIII Petroleum, Gas and Energy Summit, a brief remark from Orlando Velandia, president of Colombia’s National Hydrocarbons Agency (ANH), set off a wave of speculation across the oil and gas sector.

Canacol Energy Ltd. (TSX: CNE) have obtained an initial order for creditor protection from the Court of King’s Bench of Alberta pursuant to the Companies’ Creditors Arrangement Act (the CCAA).

Ecopetrol published its 3Q25 financial results recently and as might be expected, the headlines screamed that earnings had fallen 28% which, in fact, they had, year-over-year. Sequentially however, they were up 41%. Should Ecopetrol be castigated for the year-over-year, applauded for the sequential growth, both or neither?

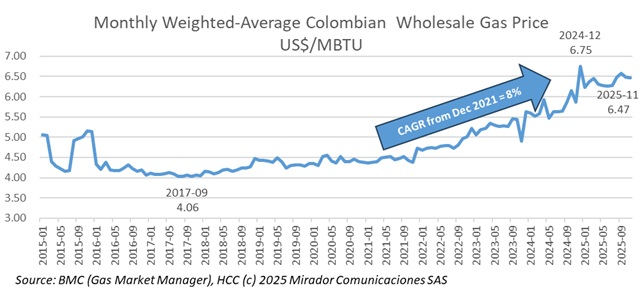

Colombian households are feeling the strain of rising gas prices after a sharp 13.28% increase over the last year, making gas the second-fastest rising item in the national consumer basket, surpassed only by coffee.

Colombia’s energy transition, one of the flagship promises of President Gustavo Petro’s administration, was thrust into the spotlight after attorney Carlos Roncancio filed a formal complaint before the Inspector General Office, alleging that public resources destined for the process were never translated into real execution on the ground.

Colombia’s natural gas sector is at a crossroads, and the obstacle, according to Naturgas president Luz Stella Murgas, is not geological scarcity but political indecision.

The Petro administration has revived its push for a revised tax reform, now scaled down to CoP16.3T, roughly CoP$10T less than the original proposal. But the path through Congress remains uncertain.