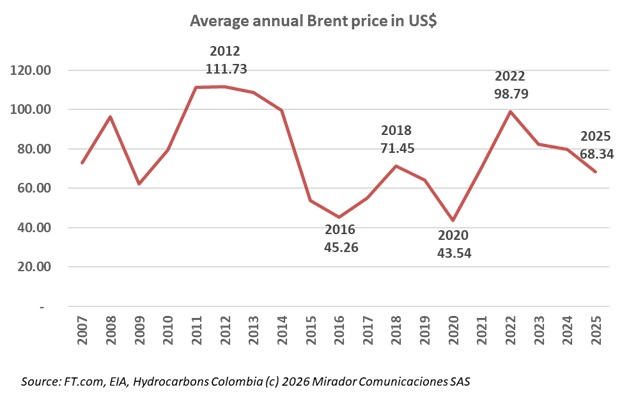

Despite the dramatic U.S. military intervention in Venezuela and Nicolás Maduro’s capture, global oil markets have shown minimal reaction, revealing that oversupply concerns far outweigh geopolitical volatility from a country holding the world’s largest crude reserves.

Ecopetrol S.A. announced January 7, 2026, that nine additional labor organizations have initiated renegotiation of their respective chapters of the Collective Bargaining Agreement by filing complaints with Colombia’s Ministry of Labor within the legally established timeframe.

President Gustavo Petro’s surprise 23% minimum wage increase for 2026 forced Colombian financial analysts to hastily revise their macroeconomic projections on New Year’s Eve, with expectations shifting dramatically for inflation, GDP, dollar exchange rates, and unemployment.

We should just write 500 words on why accurate forecasting this year will be impossible, add 200 words on the benefits of scenario-based planning and try to otherwise keep our head down. But we promise you courageous comments so here we go.

Despite the Petro government’s criticism of U.S. intervention in Venezuela following Nicolás Maduro’s capture, Energy Minister Edwin Palma signaled openness to negotiating with the Trump administration.

Frontera announced a commitment to deliver production to Chevron and a corresponding prepayment agreement.

The Colombian Petroleum and Gas Association (ACP) General Assembly designated members of the Board of Directors for the 2026-2027 period and appointed its new Executive Board, who will assume leadership of the association’s Board of Directors for one year.

The Colombian gas producer published an update press release on its website. We also picked up an item on CNE from Superservicios.

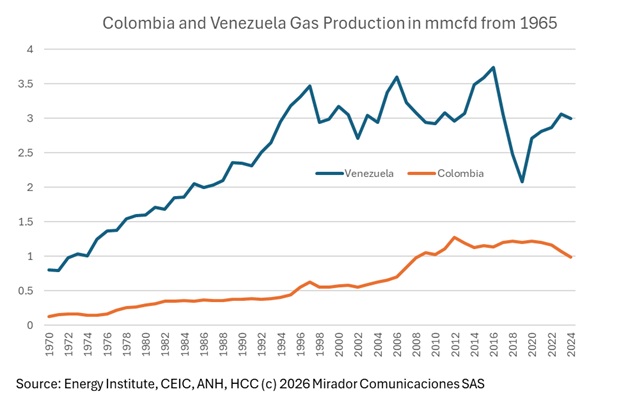

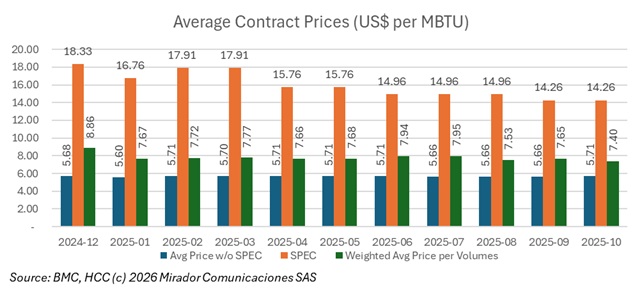

President Gustavo Petro requested that state-owned Ecopetrol substantially reduce internal natural gas prices as Colombia confronts a growing gas shortage forcing dependence on costlier imports. According to the country’s commodities exchange, internal gas production is projected to fall up to 20% below demand next year.

Promigas announced on December 23 a new advance in the Barranquilla-Ballena Bidirectionality Project by placing into operation, ahead of schedule, 20 mmcfd of additional natural gas transport capacity between the Caribbean coast and Colombia’s interior.