During the VII Oil, Gas, and Energy Summit, Orlando Velandia, President of the National Hydrocarbons Agency (ANH) of Colombia, addressed critical concerns about the country’s natural gas sector, particularly the looming deficit projected for 2025.

At the close of the ANIF Capital Markets Seminar, Ángela Hurtado, President of JP Morgan Colombia, talked about the key factors driving investment capital outflows from Latin America and how this region’s behavior contrasts with the rest of the world.

The ELN process is suspended! No wait. We reported that last month. But this month, Petro confirmed it. He’s given up on them. Still old news. The process with the Segunda Marquetalia almost fell off the rails but the two sides will meet now in Cuba. Didn’t we say that before? Maybe. Or something similar. The Clan? No change? Mordisco? Still blowing things up? Calarca? Not clear. Yesterday’s news.

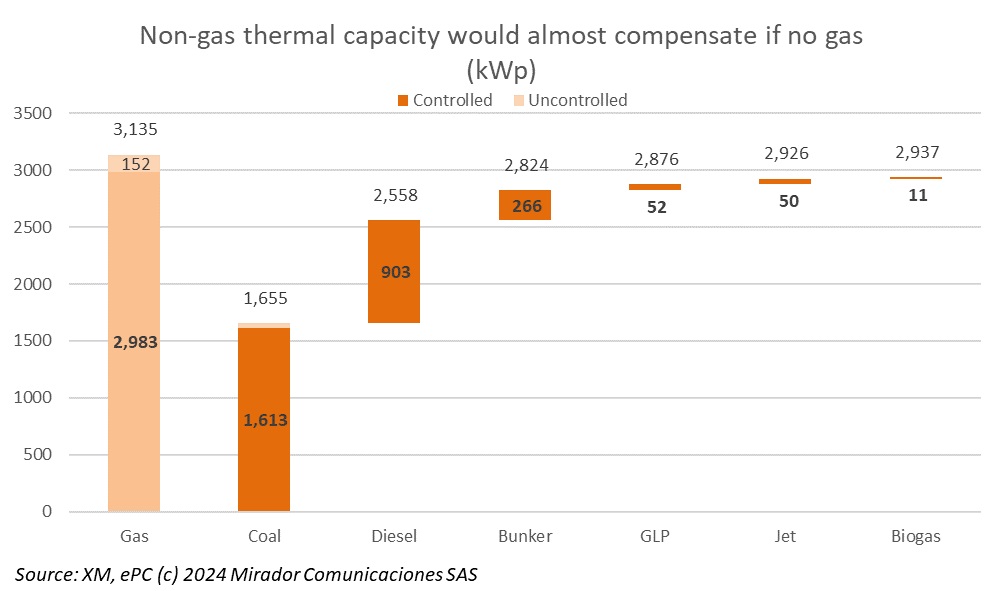

Bruce Mac Master, president of the National Business Association of Colombia (ANDI) and the Business Council, issued a stark warning regarding the country’s energy future.

Colombia continues to grapple with deep economic disparities, ranking as the third most unequal country in the world in terms of income distribution, according to recent data from the World Bank.

Recently, the Ministry of Environment (MinAmbiente), headed by Susana Muhamad, made the decision to suspend the environmental licensing process for the Komodo-1 well.

Minority shareholders of Ecopetrol (NYSE: EC), including pension funds, are calling for an extraordinary meeting to elect a new representative to the company’s Board of Directors.

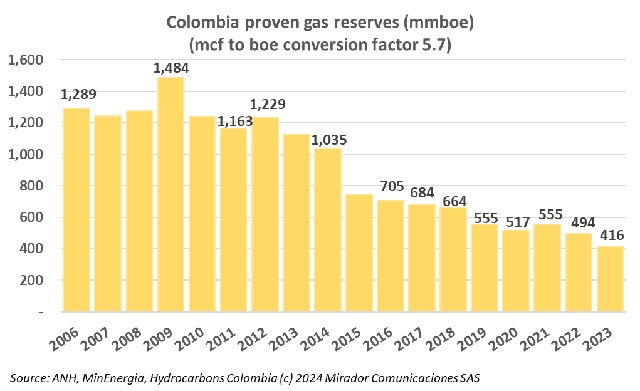

Ecopetrol (NYSE: EC) urged the government to take necessary measures to secure the supply of natural gas for 2025 and 2026.

Ecopetrol (NYSE: EC) is making strides towards securing the natural gas supply for over 36 million Colombians as part of its 2024-2034 strategic plan.

As Colombia faces its lowest reservoir levels in 40 years due to a prolonged drought, the country is increasingly relying on thermoelectric plants to prevent energy rationing.