The USO said that the 12,000 striking workers at the Cartagena Refinery (Reficar) are being repressed through strong arm tactics at the hands of the police SWAT force Esmad.

The Autonomous Corporation of Alto Magdalena (CAM) says that none of the 12 hydrocarbons transport firms operating in the department have a contingency plan approved by the regional authority.

The count went up to 28, the first rise in a month but still below recent and long-term averages. This was a below average week for non-armed forces reported/guerrilla-initiated incidents. Our 4-week Moving Average incident count was up to 24.0 incidents (breaking a streak of 9 straight declines) but the 52 week average was essentially stable at 38.6 incidents per week.

Colombia’s National Learning Institute (SENA) has made a public call for bids to build a new training center that will specialize in hydrocarbons in Puerto Gaitan.

A meeting to discuss repairs to the Paz de Ariporo – Hermoso highway brought together the Paz de Ariporo mayor, the Casanare Department governor Marco Tulio Ruiz and community leaders, but reps from oil companies did not show up despite the community’s invitation.

This week Colombian President Juan Manuel Santos took to campaigning for the peace process, one of the foremost issues that will make or break his upcoming reelection bid next year.

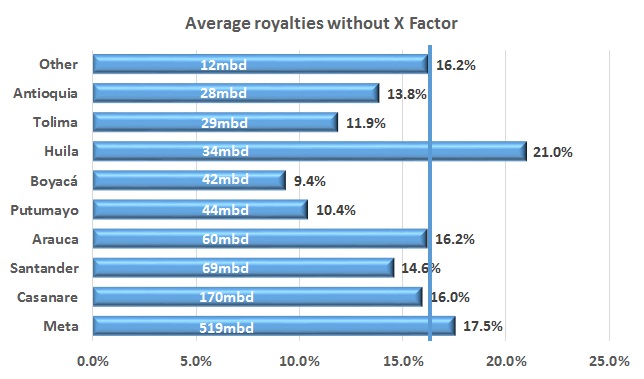

It is a stereotype that rolls easily off the tongue: the Colombian royalty rate is 20%. Data from 1Q13 shown above shows that it is not. The bars represent the average royalty rate for the top producing departments (excluding X Factors paid on E&P contracts) and the figures displayed on the bars themselves is average daily production in thousands of barrels per day.

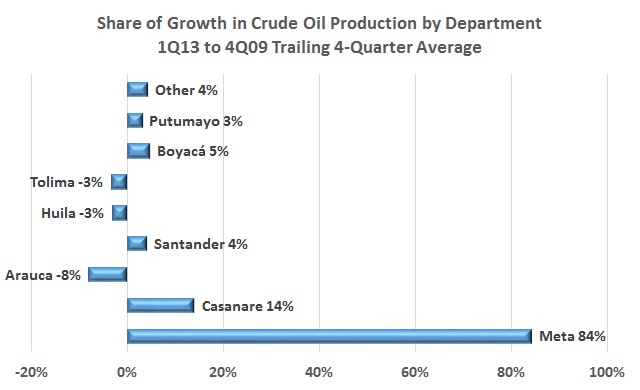

ProductionMinMinas recently published its detailed file with production by field, which allows us to do graphs like the above, looking at the growth in production by department.

An association of around 600 fishermen says that offshore exploration near the city of Cartagena is advancing without their input or consultation.

The USO says that a mass strike of workers at the expansion of the Cartagena Refinery (Reficar) has been in effect for 8 days now. According to the union, 12,000 workers are now demanding greater hiring of local and national laborers, and that salaries and work conditions are the same as foreign workers on the site.