Colombian senator Martiza Martínez introduced a legislative bill that would establish a law requiring that seismic exploration for oil reserves first receive an environmental license to move forward.

Venezuela’s need for gas may prompt its NOC PDVSA to attempt to extend the contract it has with Ecopetrol past its current expiration date of 2014. How Colombia’s supply or problems in payments for the gas could change as a consequence still remains a question.

Talisman Energy says that production in Colombia met production targets for the second quarter of 2013, but is facing delays due to community issues and “surface access issues”.

The General Royalty System (SGR) published a summary of the funds it paid out to approved projects in the months of May and June. In total CoP$63.438M (US$33.4M) in payments were sent for the period to 59 individual projects.

Colombia’s Chamber of Oil Goods and Services Campetrol recently held its first business roundtable to pair local service providers and suppliers with larger operators. The organizers say the event surpassed its expectations considering it is the first of its kind.

GasAs the El Niño weather pattern cuts into overall rainfall, depleted supplies at hydroelectric dams mean thermal-electrical production has compensated to stabilize Colombia’s electrical supply, pushing demand for natural gas up by 45% in July, compared to the previous year.

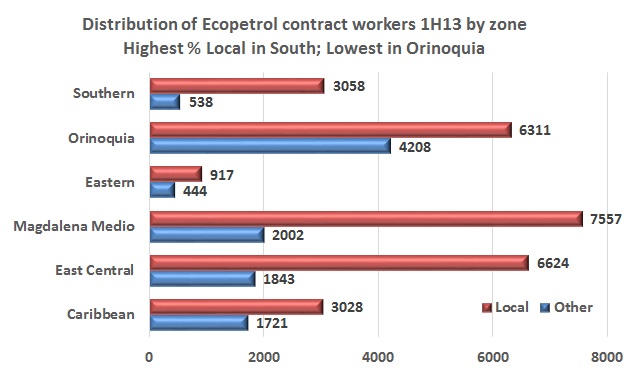

Ecopetrol says that in the first half of 2013 more than 37,000 people worked on job sites and projects of the NOC each month through associated contractors. While they didn’t provide any comparison figures, the company did say local labor was used to fill 72% of these positions.

The municipality of Trinidad in the Casanare Department says that a public-private partnership has allowed the entity to make repairs to the local well site and has applauded the relationship between the mayor Jesus Cuevas and oil producers operating in the region.

In July the General Royalty System (SGR) approved 67 science and technology projects which will receive CoP$588.122B (US$311.3M) in royalty funding, the most relevant funding of its sort for these ends since the new royalty system was established over a year ago.

Company executives of the Cartagena Refinery say that striking construction workers are not affecting the current production in the plant, although it is pushing the expansion costs higher.