Representatives from 17 oil companies signed an agreement with the Casanare Departmental government in Yopal that establishes an action plan on social issues, productive projects and road infrastructure for the next two and a half years.

The Bicentennial Pipeline (OBC) says it will be operational sometime in the fourth quarter of 2013, which signifies another delay in the launch of the 960km, up to 150,000 barrels a day transport infrastructure.

President Juan Manuel Santos addressed the 68th general assembly of the United Nations in New York and looked to put questions into the peace process from the International Criminal Court (ICC) in the past.

The central government is aware the general royalties system (SGR) is not working as best it could, a little more than a year after its implementation, and is open to making adjustments, according to the Mines and Energy Minister Amylkar Acosta.

Following a decision early this month from the Constitutional Court that the executive branch could no longer set fuel prices, the court has also rejected a request to suspend the ramifications of the ruling for a year.

Reclame Colombia, an activist group advocating small scale mining over multinational, large-scale projects, held a debate in Bogotá on the future of the Rubiales field after the concession contract held by Pacific Rubiales (TSX:PRE) expires.

A company called Carman Internacional is allegedly responsible for an oil leak that contaminated the Cartagena Bay with at least 5,000 liters of crude from a makeshift oil storage pools. Ecopetrol (NYSE: EC) has intervened to clean up the mess.

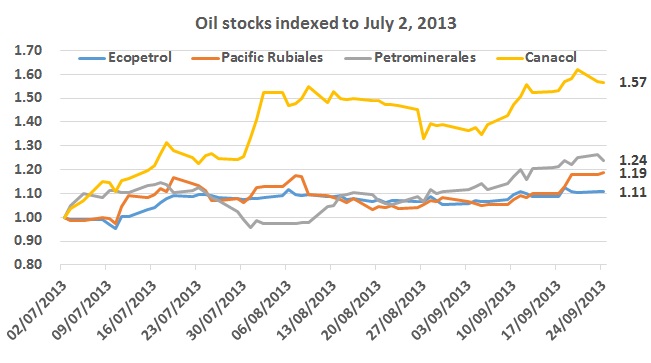

Investors who bought any of the four oil stocks listed on the Colombian stock exchange on July 2nd would be happy but those who bought Canacol will be especially happy.

Pacific Rubiales Energy (TSX:PRE) has formed new subsidiaries that will focus on the export of natural gas from production fields in the Sucre Department.

Nubia Orozco Acosta has been sworn in to run the National Environmental Licensing Authority after its former director Luz Helena Sarmiento took the Environmental Minister’s role earlier this month.