That is the conclusion of an Invermer Gallup poll done for national business magazine Dinero, published in a recent issue. The graph shows selected items from the article.

Monterrey has seen a repeat of blockades and community complaints about the oil industry, and now the municipality is forming a committee with local businesses owners to get their voices heard. Is this just a money or attention grab, or are there legitimate claims?

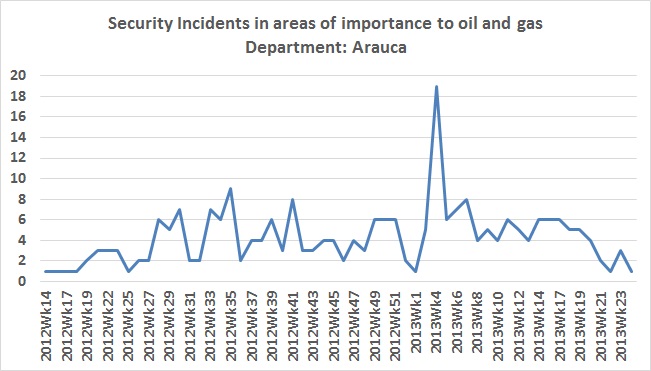

Law enforcement and officials from the Arauca Department held an extraordinary meeting of the region’s security council to analyze the wave of terrorist activity which has fell upon the department.

Colombia’s Energy & Gas Regulation Commission (CREG) has started the process to contract an administrator of the natural gas market, part of its long term wide reaching evolution of how the gas market is regulated.

Ecopetrol (NYSE:EC) says that it signed CoP$14T (US$7.44B) worth of contracts with suppliers from January to September of this year, of which 92% went to Colombian companies.

After a rise in terrorist activities targeting energy infrastructure, kidnappings and extortion in Eastern Colombia the national police, Ecopetrol (NYSE:EC) and the Attorney General’s office have signed a cooperation agreement to combat the rise in security threats.

A total of 46 oil producers in Colombia, roughly 70% of the industry, say that operational restrictions from community blockades are a primary concern when operating in the country.

After a rise in terrorist activities targeting energy infrastructure, kidnappings and extortion in Eastern Colombia the national police, Ecopetrol (NYSE:EC) and the Attorney General’s office have signed a cooperation agreement to combat the rise in security threats.

The Minister of Environment and Sustainable Development (MinAmbiente), Luz Helen Sarmiento held her first meeting with the general directors of the regional autonomous environmental authorities, or CARS, to discuss the work agenda between the regional entities and the central government.

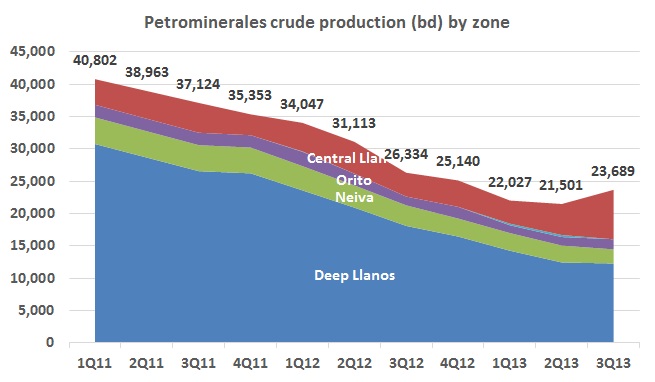

While in charge of Petrominerales (TSX:PMG), Jack Scott would tell everyone from humble scribes like ourselves to Canadian ambassadors to Colombian government ministers of the importance of agile licensing for maintaining production. Now on the threshold of a sale to Pacific Rubiales (TSX:PRE), PMG reports the first increase in production in nearly three years.