The momentum towards unconventional oil extraction in Colombia is gaining, but the industry is still lacking an established supply chain to support the operations, as well as more clarity in regulatory matters said the director of the Colombian Petroleum Institute (ICP) Andrés Mantilla Zárate.

The holiday season has passed us by, and the increase in spending does not just apply to retail shoppers looking for gifts, there have been a number of corporate social responsibility (CSR) projects that have came to fruit during the holiday season. From toys, to training to highways, here is a summary of some of the top programs making local headlines in December 2013.

The arrival of Javier Betancourt as the new president of the National Hydrocarbons Agency (ANH) led to the resignation of three of the five leading posts in the entity and new appointments aligned with Betancourt’s mandate.

The USO is back at full stride this week and leading last week’s list of statements were accusations that two of the four members detained recently for public order problems are facing a complex situation inside jail and lives are at risk, and repeated accusations that the government is targeting union members at the bidding of multinationals such as Pacific Rubiales (TSX:PRE).

The Minister of Mines and Energy (MinMinas) Amylkar Acosta Medina said that mining and energy companies can only make their projects viable by earning a “social license”, that is, respect with the local community through social impact and responsibility actions.

Incidents near areas of interest to the oil and gas industry were up significantly this week at 47, the highest level since early March. Non-Armed Forces-reported incidents were above average in absolute terms but below average as a percentage of the total. This is our indicator of increased guerrilla-initiated activity. Our 4-week Moving Average incident count was up at 28.8 and the 52 week average was actually down slightly but essentially unchanged at 32.6 incidents per week.

This week marks the start of a critical phase for the peace talks in Havana, Cuba. Save four incidents, the Farc kept their word on a month long truce over the holidays, which came to a close on January 15th. Meanwhile next Monday, January 20 the first round of 2014 gets moving, and time is running out.

The general manager of EAAV, the sewage and aqueduct company of Villavicencio Hector Castro says that seismic exploration near the aqueduct’s intake has the potential to collapse the infrastructure.

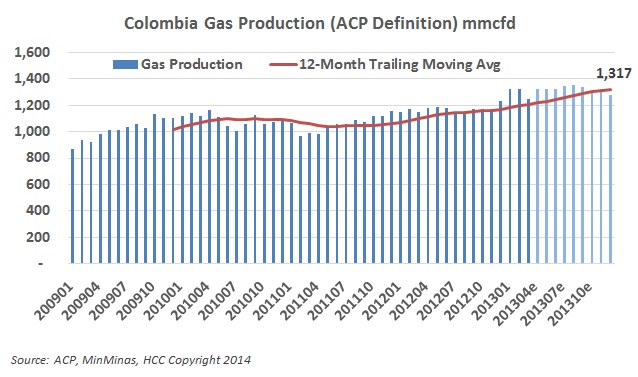

Naturgas, the Colombian association that represents the natural gas value chain from producers to distributors says the country has reserves for 14 to 15.7 years of demand.

In the Huila Department local highway police figures have found a sharp increase in the number of accidents involving tanker-trucks. In 2012 there were only three such accidents reported, while in 2013 that number spiked to 19, more than six times greater.