A proposal from the National Infrastructure Agency (ANI) to route tanker-trucks carrying crude from the Rubiales fields through the municipalities of Maní and Aguazul has a number of local officials in arms over the possible ramification of the increased tanker traffic.

The Caño Limon –Coveñas Pipeline, an asset of Ecopetrol (NYSE:EC), announced the awarding of the maintenance contract to a new operator, and while some in the local press are interested in the opportunities this may bring, others have rejected it as a change of façade and nothing else.

The USO and CB&I (NYSE:CBI), the contractor in charge of construction of the expansion of the Cartagena Refinery (Reficar) sat down along with national authorities and Ecoperol (NYSE:EC) representatives to follow up on a collective labor agreement reached last year.

Colombia’s oil and gas sector led the market with an average salary increase of 5,6% in 2013, well above accumulated inflation for the year of 1.9%, meaning workers in the industry increased their buying power last year.

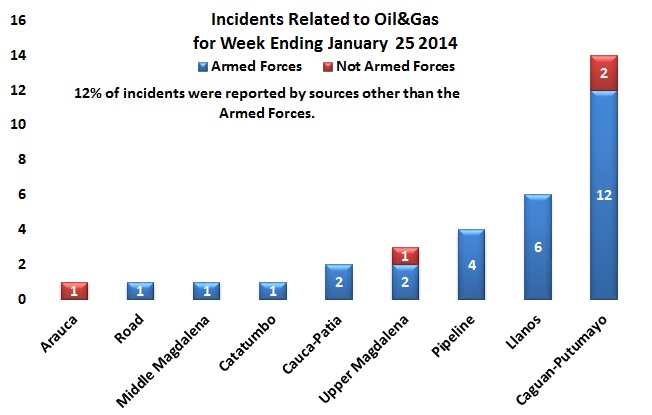

Incidents near areas of interest to the oil and gas industry were down from last week’s recent peak at 33 but right at recent and long-term averages. Both last week and this week may be underestimated for reasons explained below. Non-Armed Forces-reported incidents were above average in absolute terms but below average as a percentage of the total. This is our indicator of increased guerrilla-initiated activity. Our 4-week Moving Average incident count was up at 33.0 and the 52 week average was actually down slightly at 31.9 incidents per week.

To date the government’s Special Programs for Peace Fund of the executive branch has spent CoP$14.5B (US$7.3) on facilitating the necessary conditions for the peace process in Havana, Cuba.

Ecopetrol (NYSE:EC) has suspended its NFE Backland project, involving a new well in the Cupiagua field, after it received ‘undue pressure’ from the community over local hiring and its social investment, which the NOC says exceeded expectations.

There was lots of speculation leading up to the Ecopetrol (NYSE:ECP) Special Assembly today. However it was anticlimactic in the final result.

The coordinator of environmentalist NGO El Mastranto Manuel Peña has accused eight oil companies, led by Pacific Rubiales (TSX:PRE) of extracting water from pools designated for livestock and the Guachiría river, which local authorities say may or may not be illegal.

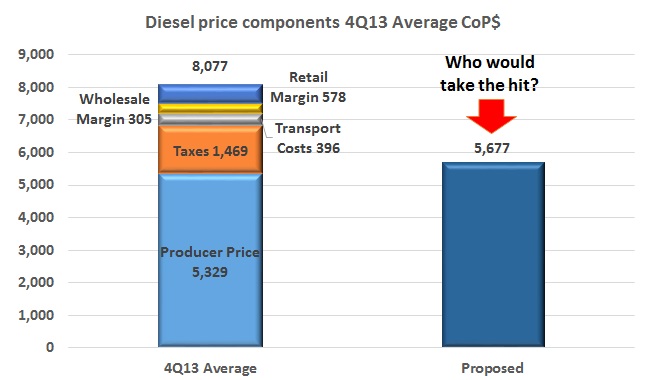

MinMinas resently opened negotiations with various truckers’ associations and representatives of other large domestic users on the stabilization formula for gasoline and especially diesel prices.