Company officials held a call to discuss the end of year 2013 results and convince the market that its continued growth over the last five years is sustainable going forward despite operational complexities.

This week revelations hit the press that President Juan Manuel Santos’s email account has been compromised and around 1000 emails were accessed by an unknown party, just weeks after allegations of spying on peace delegates in Havana shook up the process.

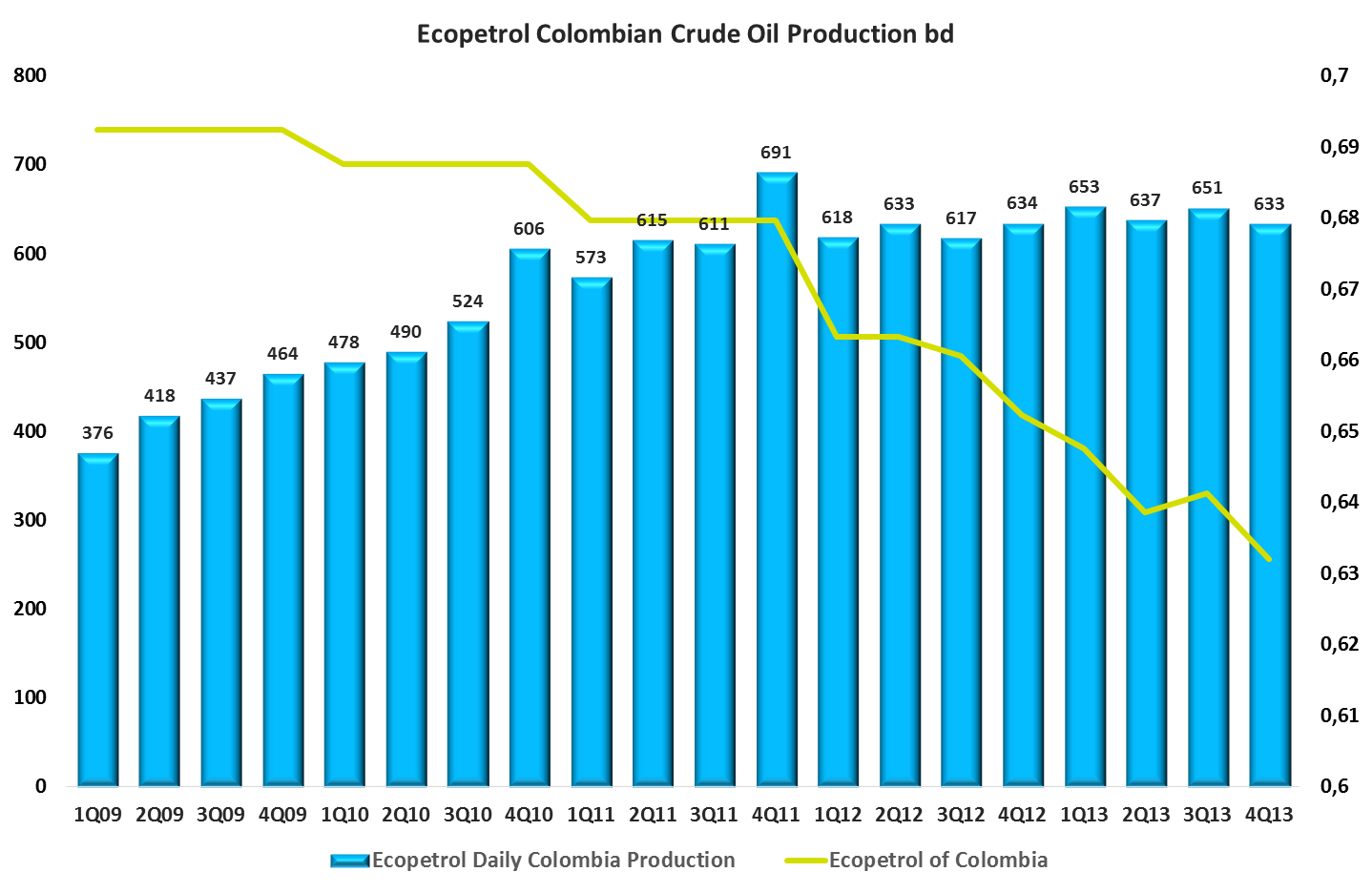

Ecopetrol (NYSE:EC) saw its production grow 4.5% in full year 2013 to reach 788.2mboed, a number which the NOC said suffered due to transport restrictions and blockades in some communities. The company’s net income fell in the same period by 10.8% to CoP$13.35T.

The National Planning Department is threatening to cut of royalty payments to municipal and departmental entities who received royalties for projects in 2013 but that have not yet filed a transparency report that details how the money was spent.

The National Hydrocarbons Agency (ANH) has published the draft reference documents and other supporting material for the upcoming Colombia 2014 Round where it looks to assign up to 97 E&P blocks.

Last weekend the Arauca Department suffered a number of attacks on public roadways and oil infrastructure after an uptick in activity from insurgent groups operating in the area.

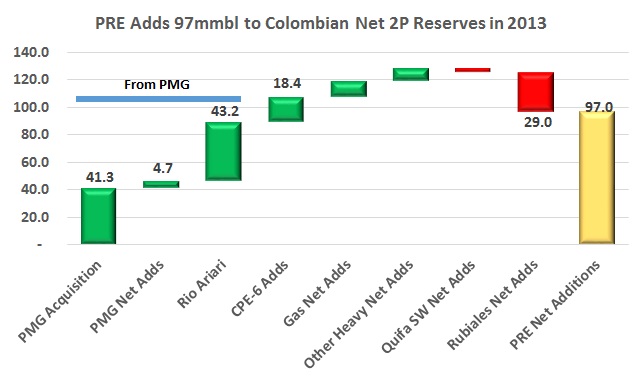

Pacific Rubiales reported its 2013 Colombian 2P reserves which increased 97mmboe or 22%. The graph shows the Petrominerales acquisition was critical to this, contributing 89 of the 97mmboe.

Colombia’s Council of State has ruled that a municipal public referendum involving Colombian subsoil exceeds the power of that entity, after Ecopetrol (NYSE:EC) challenged a decision by a Casanare tribunal to accept a referendum from the Monterrey municipality.

The continued conflicts in the municipality of Acacias and Castilla La Nueva have led to blockades, riots with police and now Ecopetrol (NYSE:EC) has terminated 45 contracts associated with projects in the area.

Colombia’s roads have become ground zero for conflicts between the oil industry and local communities, as production rises and trucks increase, so do problems, accidents and rejection of the large tankers. Here are some of the stories hitting press over the last week.