Ecopetrol has a number of programs including bridge improvements and educational programs, while Raven says its ready to invest in social programs and Llanopetrol is backing students for petrochemical studies. These and other Corporate Social Responsibility programs to make local press lately.

Local hiring and the ongoing debate between the economic benefits to the local economy achieved through using tankers to transport crude stood out as the top items in this week’s road review.

Huila governor Carlos Mauricio Iriarte Barrios said that there is an opportunity for departments in Colombia’s south to join forces to become more competitive to win royalty projects that meet the needs of this region.

Citing shifting, exaggerated demands and requirements from the local community near its Llanos 30 block E&P operations, Parex has decided to close the operation and cancel contracts with local suppliers.

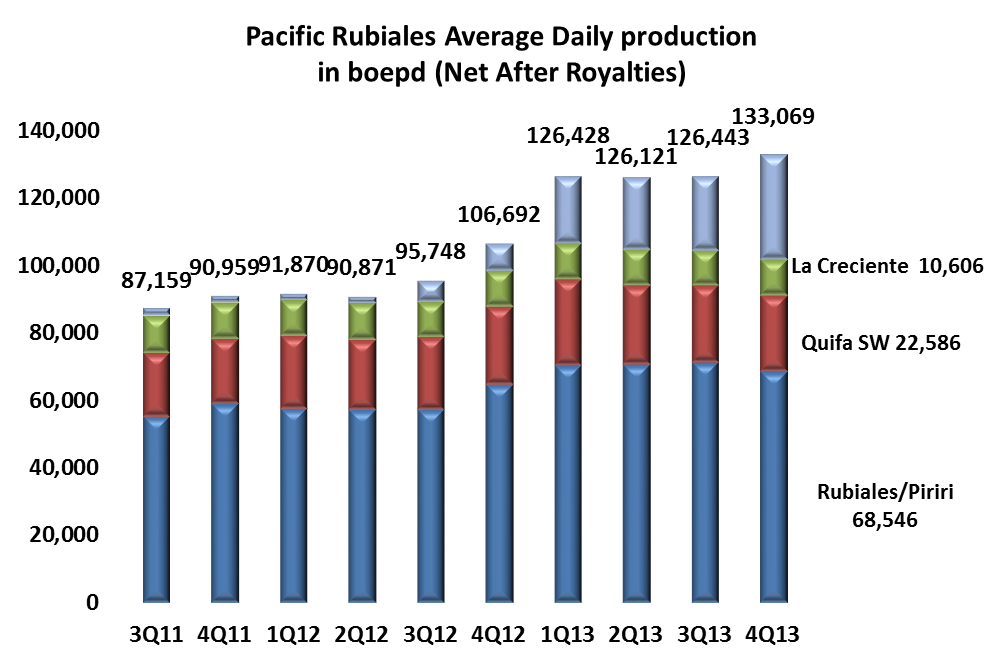

Pacific Rubiales Energy (TSX:PRE), says that it plans to leave its flagship field, Rubiales, as a success of the past, saying that it now represents only 11% of its proven reserves and that by the end of 2016 it will have been replaced. This process continues to define the company’s message to the market.

Incidents near areas of interest to the oil and gas industry were steady at 45, still above recent and long-term averages. Non-Armed-Forces-reported incidents were above average both in percentage and absolute terms. This is our indicator of increased guerrilla-initiated activity. Correspondingly, our 4-week Moving Average incident count was up at 42.0 and the 52 week average was steady at 31.2 incidents per week.

The growing demand for diesel and Colombia’s environmental requirements for the fuel, paired with a limited internal capacity of Ecopetrol (NYSE:EC) to produce this fuel could mean an increase of imports of the fuel by 7.4% in 2014.

The USO has said that it has presented a new list of terms to Ecopetrol (NYSE:EC) which surround a number of policy changes and increased benefits, stances on several environmental issues, and will hold a vote among USO affiliated workers with the NOC on April 25, 2014, in order to demand a new collective bargaining agreement.

Editor’s note: This version of the story clarifies that Gran Tierra Energy had indeed issued a press release to certain local media outlets informing that the suspension of trucks would be a temporary arrangement after HCC received the full release from the company.

The public hearing to grant the environmental license for the Llanos 10 exploratory drilling project came to a close, and with no fanfare, or public condemnation of the project, authorities or grandiose accusations.