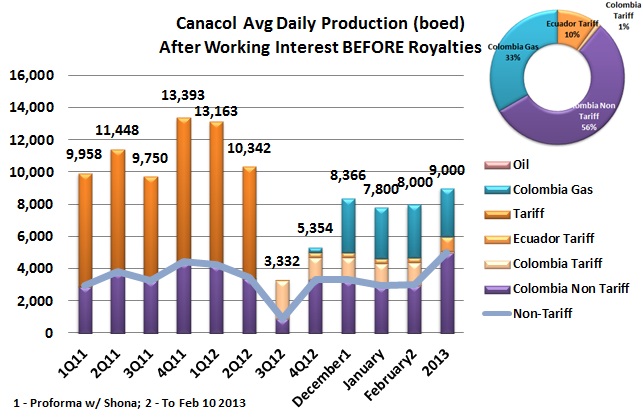

A couple of weeks ago we published a variation of this graph based on the production guidance that Canacol published at that time. Canacol being Canacol the picture was not crystal clear and so we made some assumptions to fill in the blanks. Now with 4Q12 results, the picture is not perfect but it is clearer. The principal assumption that we made was that Ecuador would have what the company calls Non-Tariff production i.e. not Tariff which is their word for what amounts to an oil services contract to operate a well for a set fee per barrel. It is now clear that that is not the case and Ecuador will be only an oil services contract which the company says is higher margin than their Colombian contract.