Thursday, January 22nd, 2026

Colombia’s dollar has weakened to around CoP$3,650, its lowest level since President Gustavo Petro took office, but market analysts warn the exchange rate is artificial and disconnected from economic fundamentals.

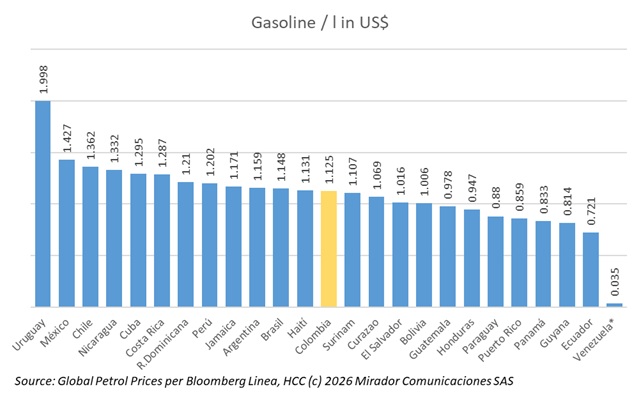

Gasoline prices vary dramatically across Latin America, with the global average at US$1.28 per liter, according to Global Petrol Prices data for early 2026.

Colombia’s vehicular natural gas prices increased 80% between 2022 and 2026, rising from approximately CoP$1,930 per cubic meter to nearly CoP$3,490, with annual average increases of 18% confirming a sustained upward trend at service stations.

A new GAD3 poll revealed by Noticias RCN shows Iván Cepeda (Pacto Histórico) leading Colombia’s presidential race with 30% voter intention, followed by Abelardo de la Espriella (Defensores de la Patria) at 22%, and Paloma Valencia (Centro Democrático) at 3%. The survey of 1,207 respondents carries a 2.83% margin of error.

César Eduardo Loza was elected as Ecopetrol’s eighth board member, marking the first time in the state oil company’s 74-year history that a worker representative will participate in strategic decision-making.

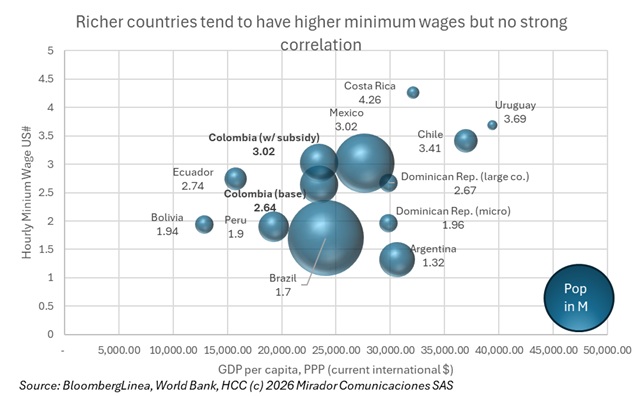

Costa Rica, Uruguay, and Chile continue leading Latin America with the highest hourly labor costs based on 2026 minimum wage rates. The analysis assumes a standard workday of 8 hours daily and 22 working days monthly, though this may differ from legal calculations in each country.

Parex published its operational and CAPEX guidance for this year. It also announced that founder Wayne Foo would retire as Board Chair and Director of the Board, effective May 12, 2026.