Wednesday, February 4th, 2026

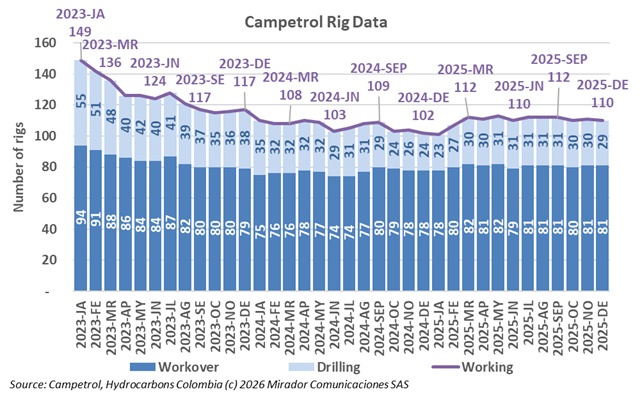

Colombia’s oil and gas drilling activity registered modest growth during 2025, with average drilling rigs reaching 110 units between January and December, representing a 2.8% year-over-year increase according to data from the Colombian Petroleum, Gas and Energy Chamber (Campetrol).

GeoPark CEO Felipe Bayón outlined an aggressive growth strategy following the company’s US$375 million acquisition of Frontera Energy’s Colombian assets, emphasizing the transaction represents long-term confidence in Colombia’s energy sector despite perceived risks.

Ecopetrol President Ricardo Roa confirmed the company’s Permian Basin field in Texas could be among assets under evaluation for divestment, responding to government opposition to fracking technology. The field, acquired under 2020 contracts, requires operational agreement updates and strategic decisions on future extraction.

Ecopetrol and Frontera Energy marked World Clean Energy Day with the inauguration of the new Quifa Solar Farm, incorporating 18MWp in the first quarter of 2026 and advancing Colombia’s energy transition.

Geopark announced a transformational acquisition of Frontera Energy’s entire Colombian exploration and production portfolio for US$375M cash at closing plus US$25M contingent upon achieving development milestones.

Colombia’s Constitutional Court suspended President Gustavo Petro’s economic emergency decree, halting multiple tax measures that would have significantly impacted the petroleum and mining sectors.

Mónica de Greiff, former president of Ecopetrol’s Board of Directors, explained in an extensive Revista Semana interview the circumstances surrounding her October 2025 resignation after initially attempting to resign in May 2025.