Wednesday, January 21st, 2026

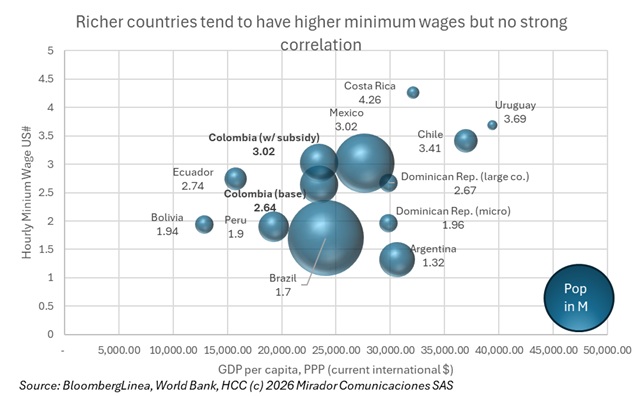

Costa Rica, Uruguay, and Chile continue leading Latin America with the highest hourly labor costs based on 2026 minimum wage rates. The analysis assumes a standard workday of 8 hours daily and 22 working days monthly, though this may differ from legal calculations in each country.

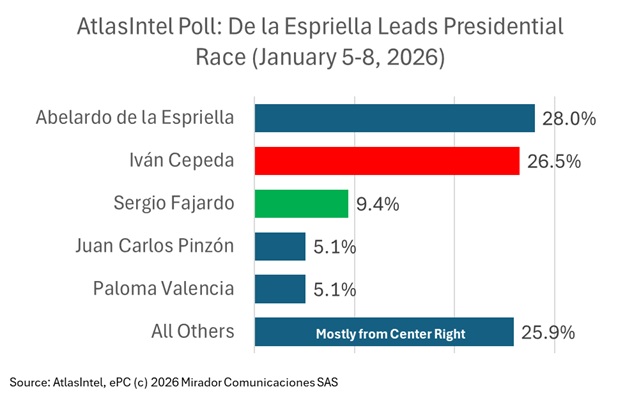

An AtlasIntel poll (sponsored by Revista Semana) conducted January 5-8, 2026, reveals Abelardo de la Espriella leading Colombia’s presidential race with 28% voter intention, narrowly ahead of Iván Cepeda at 26.5%. The survey of 4,520 participants carries a 1% margin of error for general results and 3% for party consultations, with 95% confidence level. UPDATED Bottom-Line.

The Ministry of Mines and Energy, led by Minister Edwin Palma, activated an institutional monitoring plan for strategic fuel gas sector projects aimed at strengthening supply and guaranteeing energy system functionality.

Following political upheaval in Venezuela in early January 2026, global petroleum markets are undergoing significant realignments as major players position in the new landscape. President Trump announced substantial U.S. investment plans while Canada, Mexico, India, and China reassess their energy strategies in response to Venezuela’s changing landscape.

César Loza, president of the Unión Sindical Obrera (USO), was selected as Ecopetrol’s first-ever worker representative to the board of directors in elections held January 14-15, 2026. The election marks a historic milestone, as this is the first time a worker will participate in the state oil company’s board following changes approved at November’s General Assembly.

We are only a little over two weeks into 2026 and the number one theme from last year, natural gas, is the number one theme this year.