The continued conflicts in the municipality of Acacias and Castilla La Nueva have led to blockades, riots with police and now Ecopetrol (NYSE:EC) has terminated 45 contracts associated with projects in the area.

Colombia’s roads have become ground zero for conflicts between the oil industry and local communities, as production rises and trucks increase, so do problems, accidents and rejection of the large tankers. Here are some of the stories hitting press over the last week.

A judge in Bogotá ordered the release of three USO members that were detained nearly two and a half months ago.

GasThe mayor of the Cúcuta municipality, Donamaris Ramírez-París Lobo has his eyes set on gas both to supply to local families for home use but also says there are gas reserves that could work to the community’s favor.

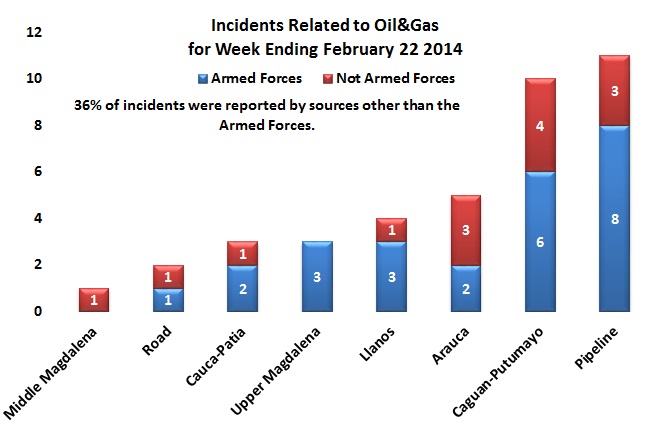

Incidents near areas of interest to the oil and gas industry were up sharply to 39 above recent and long-term averages. Non-Armed Forces-reported incidents were triple the average in absolute terms and nearly so as a percentage of the total. This is our indicator of increased guerrilla-initiated activity. Our 4-week Moving Average incident count was up at 35.3 and the 52 week average was also up slightly at 31.3 incidents per week.

Organizers booked the February 20th march for the water as a milestone for the anti-oil movement and turning of the tide towards stronger environmental regulation. The march occurred without incident in Casanare and Meta, but fell short of the loft expectations.