The national government and the U’WA indigenous community have reached an agreement that will allow repair crews to access the damaged Caño Limon – Coveñas pipeline, which has been out of service since a bombing on March 25th.

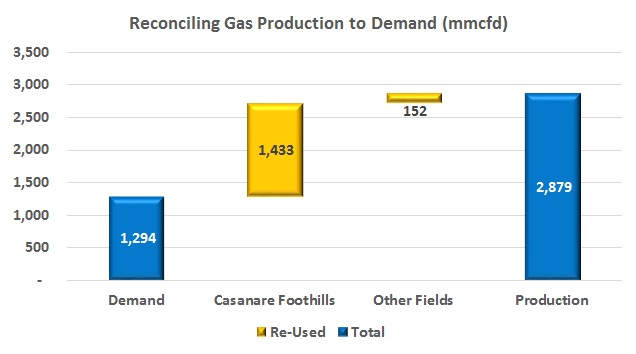

An innocent question – are there official forecasts of natural gas production? – led to an interesting discussion of the definition of ‘production’ at least as used by industry in Colombia.

Following a road show to five countries over two months after launching the Colombia Round 2014, the National Hydrocarbons Agency says that 46 companies have acquired the information packets on the 97 blocks that it is offering.

This week the topic of post-conflict justice reverberated through Colombian media, as the issue of how to apply justice to former guerrillas once an agreement has been made. The government spoke of a transitional model for justice, which drew criticism from the political right.

The U’WA indigenous community has taken over an oil well in the Toledo municipality and accused the government of skipping out on a scheduled meeting. Reports indicate that the national government may enter with troops to gain access to the damaged Caño Limon- Coveñas Pipeline. UPDATED

This month we start with an interview with Independence’s Rose Marie Saab. She gives an optimistic view of the industry but a realistic one, based both on her role as the leader of Independence – a leading oil services company –but also as the chairperson of the board of Campetrol, the services industry association.