The Colombian government’s chief negotiator in Havana Humberto de la Calle came forward with a strong statement that the talks are moving forward in Havana, and even put a time-frame on an agreement.

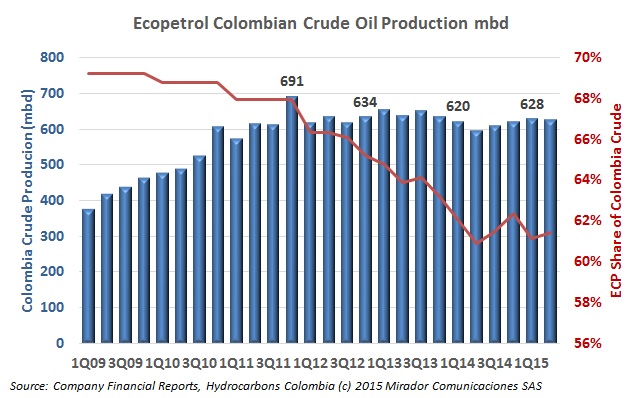

Ecopetrol (NYSE:EC) grew its profit for the second straight quarter since its first loss as a listed company in the 4Q14, with refining posting a profit and adding a boost. Production has grown yearly, but fell off slightly compared to the previous quarter.

The Colombian government’s chief negotiator in Havana Humberto de la Calle came forward with a strong statement that the talks are moving forward in Havana, and even put a time-frame on an agreement.

Despite a constant message from the Ministry of Mines and Energy (MinMinas) that a rising price of biofuels has counteracted falling oil prices to keep fuel prices higher, the president of the biofuels association Fedebiocombustibles Jorge Bendeck says its more complicated than that, and increasing the mix would actually drop prices.

Parex Resources (TSX:PXT) saw its production grow slightly in the second quarter of 2015 when compared sequentially, and posted its first profit since the fall of oil prices early this year.

Ecopetrol releases a statement denying dumping accusations while Puerto de Tumaco authorities question the Government response to oil contamination. These and other environmental stories in our periodic summary.