Editor’s Note: ACIPET, the association of Colombian petroleum engineers, is an active voice for policy change in the sector. Its recently-appointed Executive Director, Juan Carlos Rodriguez, speaks frequently to the press on what the government is doing right and not doing right.

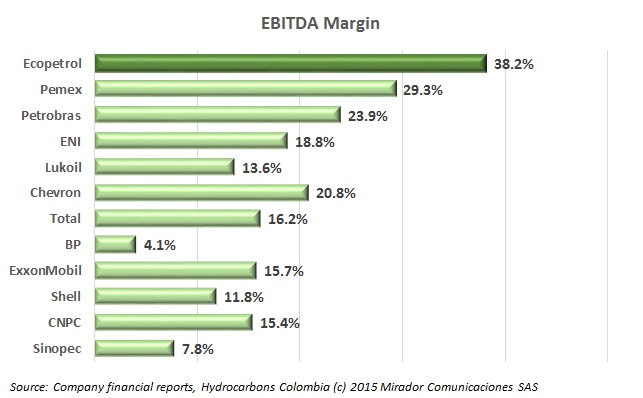

In our analysis of Ecopetrol’s 3Q15 results we reported that CEO Juan Carlos Echeverry had said the NOC was outperforming its global peers.

Shortfalls in the supply of natural gas and drought due to El Niño weather could mean that thermal electrical generators will have to increase their use of diesel to generate energy, says a report.

A group of eight NGOs present in the Paris Climate Change Summit have called on Latin American countries to prohibit fracking due to its alleged environmental impact and potential role in speeding global warming.

At HCC, we abide by the rule that we should not publish articles that are obvious or have nothing new to say. Around the office we use the rule that the worst possible title for an article would be “Man does not bite dog”. We have published a number of articles on security over the past four months but the last time we published both of our standard graphs was on September 14th. Since then there has been little to say beyond: still few incidents; ELN the only problem. However, with the end of the year approaching, we update the graphs and talk about what has – or has not – happened.

In his annual account rendering the General Controller (CGR) Edgardo Maya Villazón said that cost over-runs associated with the modernization of the Cartagena Refinery (Reficar) are one of his main concerns, and that the entity will soon release a report on its findings so far.