Thursday, February 19th, 2026

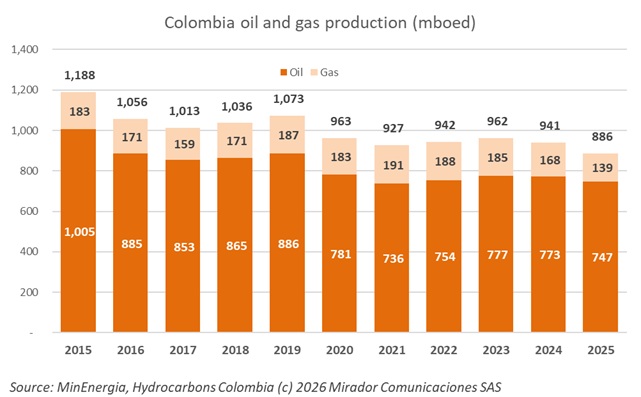

Colombia’s petroleum sector suffered significant production declines in 2025, costing the economy approximately US$660M (CoP$2.3T)—equivalent to nearly 30% of the recently declared economic emergency value—according to data from the Colombian Chamber of Petroleum, Gas and Energy (Campetrol).

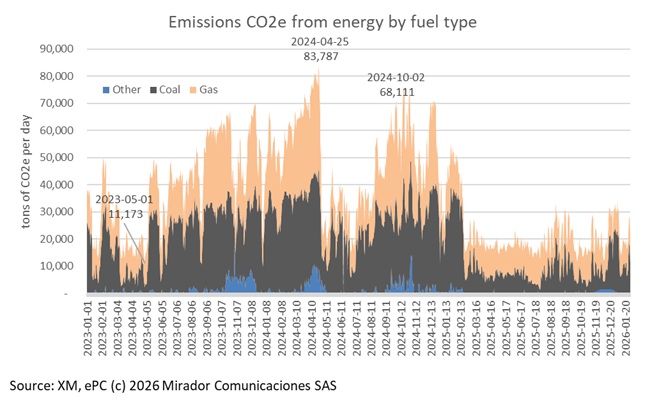

Colombia has avoided nearly 7 million tonnes of CO₂-equivalent emissions during the Petro administration through the entry into operation of clean energy projects including solar, wind, and small hydroelectric facilities, the Mines and Energy Ministry announced on World CO₂ Emissions Reduction Day.

Amazónica LNG will commission Colombia’s first land-based liquefied natural gas regasification terminal in the second half of 2027, following a US$190 million capitalization that includes US$150 million in debt financing from Mitsubishi Financial Group and US$40 million in equity from project partners.

Ecopetrol’s incoming board of directors inherited a contested and unresolved legal services contract with Washington-based law firm Covington & Burling, after the Comptroller General’s Office (General Controllers Office) issued formal audit findings warning of governance failures and a potential US$1.592 million fiscal risk stemming from the contract’s suspension.

Colombia’s Council of State suspended President Petro’s late-2025 minimum wage decree and ordered the government to issue a new provisional wage determination within eight calendar days, following strict criteria outlined by the high court. on February 13, 2026.

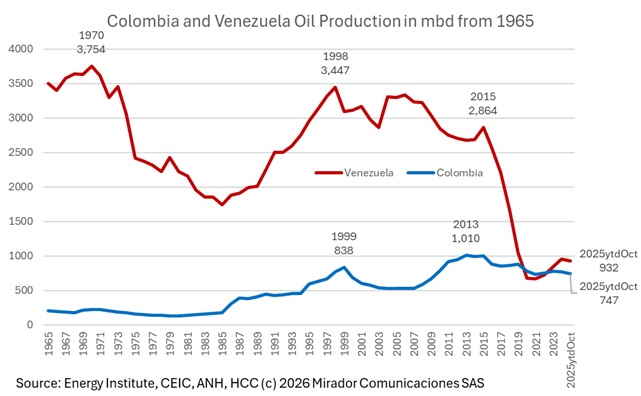

The prospect of political change in Venezuela has revived debate over what a mass return of migrants would mean—not just for Venezuela, but for the labor markets and demographics of the countries that have absorbed them over the past decade, Bloomberg Línea reported on January 21, 2026.

Despite facing formal charges from the Attorney General’s Office over alleged campaign finance violations and a luxury apartment purchase, Ecopetrol president Ricardo Roa is unlikely to be removed—and markets may actually prefer it that way, according to a leading equity analyst.