Thursday, January 15th, 2026

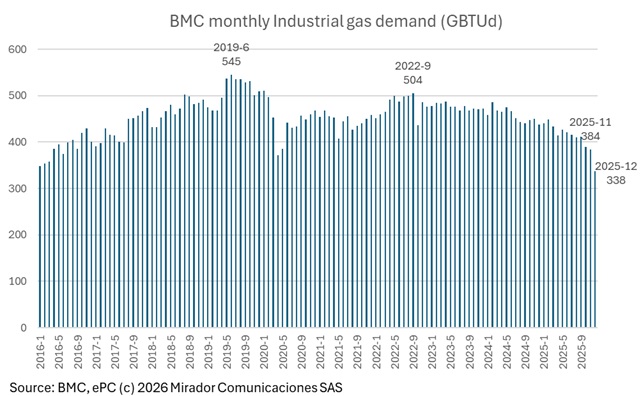

Colombia’s industrial natural gas demand fell 23.7% between November and December 2025 following sharp price increases triggered by the expiration of supply contracts on November 30.

Colombia’s 2025 inflation closed at 5.10%, with natural gas and vehicle fuels representing the largest increases within the energy basket, while electricity rates declined.

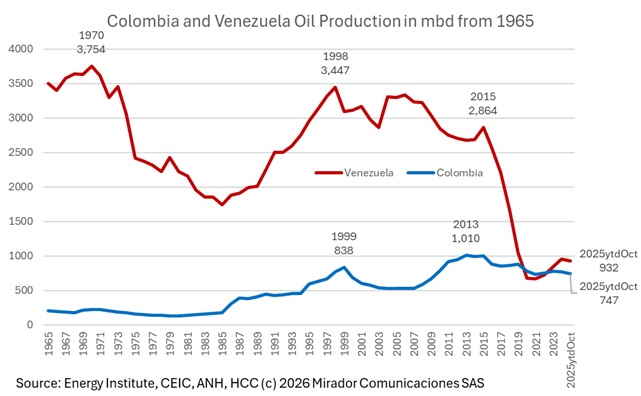

Colombia will confront a challenging oil market environment in 2026 characterized by lower prices, oversupply, and excess inventories, according to analysis from Corredores Davivienda.

A group of Ecopetrol workers filed a tutela (constitutional legal action) requesting immediate suspension of the election process for their representative to the company’s board of directors, citing alleged irregularities.

President Donald Trump’s ambitious plan to revitalize Venezuela’s oil industry through USD$100B in private investment faces significant obstacles as major oil companies express skepticism, culminating in Trump threatening Sunday to exclude ExxonMobil from the South American nation after its CEO called Venezuela “uninvestable.”

Parex issued a press release with statistical details on 4Q25 production and the results of the Guapo-1 exploration well.