Thursday, February 19th, 2026

The Ministry of Mines and Energy announced February 11, 2026, that Pablo Yesid Fajardo Benítez assumed the presidency of Colombia’s National Hydrocarbons Agency (ANH), marking what the government described as “a new phase in the management of subsurface energy resources” amid energy security challenges and clean energy transition.

DIAN notified Ecopetrol of Resolution 000571 confirming a CoP$5.3T sanction (including interest and penalties) related to 19% VAT on gasoline imports between 2022-2024, escalating the ongoing legal dispute between Colombia’s tax authority and the state oil company.

Colombia’s liquid fuels market closed 2025 with positive consumption figures driven primarily by diesel demand, though profitability deteriorates for distributors despite sales growth, according to a report presented by Somos Uno—the trade association uniting Comce Colombia and Fendipetróleo Nacional.

Colombia’s potential role in Venezuelan reconstruction—particularly through energy sector initiatives led by Ecopetrol—emerged as a central topic during President Gustavo Petro’s nearly two-hour meeting with President Donald Trump on February 4, 2026, according to Colombian Ambassador Daniel García-Peña.

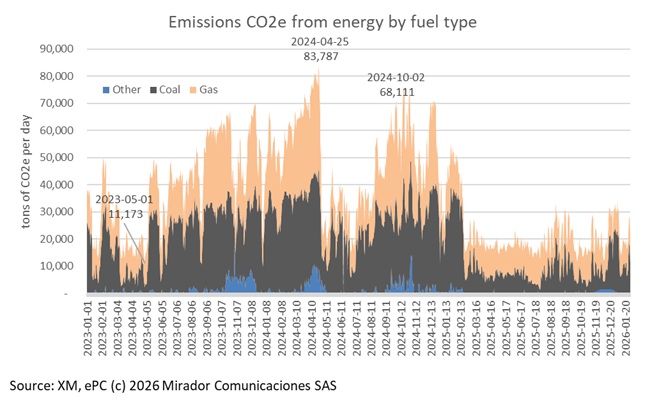

Colombia has avoided nearly 7 million tonnes of CO₂-equivalent emissions during the Petro administration through the entry into operation of clean energy projects including solar, wind, and small hydroelectric facilities, the Mines and Energy Ministry announced on World CO₂ Emissions Reduction Day.

Amazónica LNG will commission Colombia’s first land-based liquefied natural gas regasification terminal in the second half of 2027, following a US$190 million capitalization that includes US$150 million in debt financing from Mitsubishi Financial Group and US$40 million in equity from project partners.

Ecopetrol’s incoming board of directors inherited a contested and unresolved legal services contract with Washington-based law firm Covington & Burling, after the Comptroller General’s Office (General Controllers Office) issued formal audit findings warning of governance failures and a potential US$1.592 million fiscal risk stemming from the contract’s suspension.