Ecopetrol’s Unión Sindical Obrera (USO) announced support for Roy Barreras in the March 8, 2026 presidential consultation for the Frente por la Vida coalition, marking a clear break from the government coalition’s expected candidate Iván Cepeda.

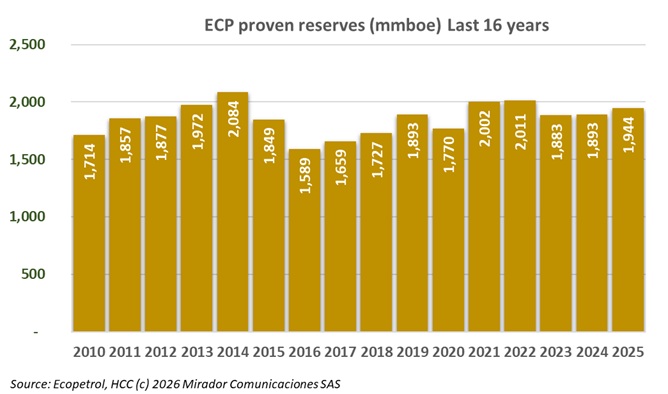

Ecopetrol S.A. reported today its proven reserves of oil, condensate, and natural gas (1P reserves), including its share in proven reserves from subsidiaries, estimated based on the standards of the U.S. Securities and Exchange Commission (SEC).

Colombia’s plans to import Venezuelan natural gas face regulatory and infrastructure obstacles following talks in Caracas between Minister of Mines and Energy Edwin Palma and Venezuelan interim president Delcy Rodríguez. While Venezuela’s side of the Antonio Ricaurte pipeline—enabled in 2007—is ready, Colombia’s segment remains non-operational and Ecopetrol cannot lead the project.

Parex Resources Inc. announced today that it has submitted an acquisition proposal (the “Proposal”) to the Board of Directors (the “Frontera Board”) of Frontera Energy Corporation (TSX: FEC) to acquire all of Frontera’s Colombian upstream business in an all-cash offer for consideration of US$500 million, plus the assumption of debt, in addition to a contingent payment of US$25 million with terms that are substantially the same as the existing acquisition agreement previously announced. The Proposal represents a US$125 million premium compared to the existing acquisition agreement.

Canacol announces a leadership change and the appointment of an independent director to the board of directors (the “Board”). The Board believes that these changes will position the Company for success in the next phase of its restructuring by adding substantial restructuring experience to the Board.

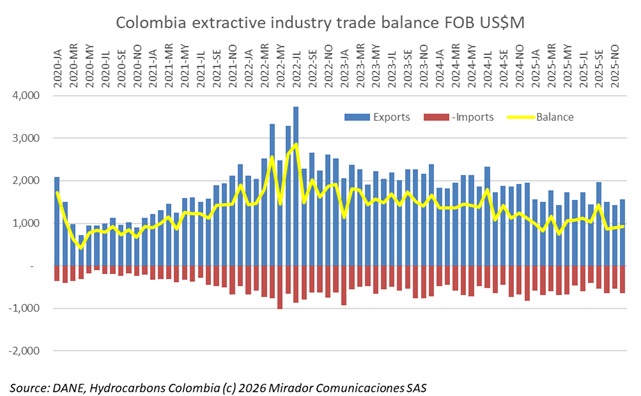

Colombia registered its worst trade deficit in history in 2025, reaching US$16.B FOB, surpassing pandemic-era records. Meanwhile, extractive industry trade balance contributed positively, although declining as well. DANE also published GDP for 4Q25 so we look at that from a sector perspective.