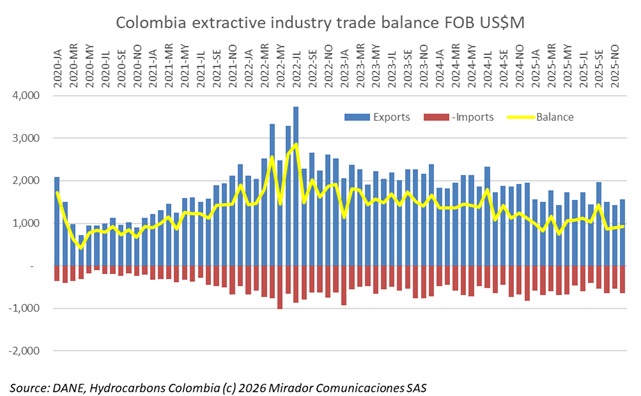

Colombia registered its worst trade deficit in history in 2025, reaching US$16.B FOB, surpassing pandemic-era records. Meanwhile, extractive industry trade balance contributed positively, although declining as well. DANE also published GDP for 4Q25 so we look at that from a sector perspective.

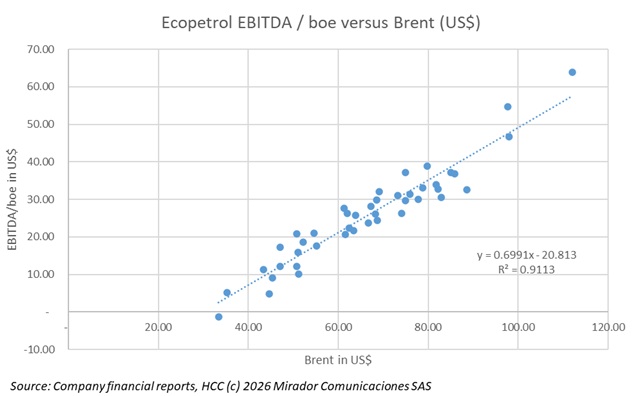

Colombia’s 2026 Medium-Term Fiscal Framework assumes Brent crude averaging US$62.3 per barrel, positioning Ecopetrol comfortably above its US$50 per barrel breakeven point quoted in third quarter 2025.

The Ministry of Mines and Energy announced February 11, 2026, that Pablo Yesid Fajardo Benítez assumed the presidency of Colombia’s National Hydrocarbons Agency (ANH), marking what the government described as “a new phase in the management of subsurface energy resources” amid energy security challenges and clean energy transition.

Promigas announced December 23, 2025, it brought online 20 mmcfd additional natural gas transport capacity ahead of schedule, increasing total capacity from 100 mmcfd to 120 mmcfd on the Barranquilla-Ballena Bidirectionality Project in a widely reported news item.

Colombia’s main Pacific port faces a complex logistics crisis requiring sustained coordination between government and private operators, according to contrasting assessments from port management and government authorities released mid-February 2026.

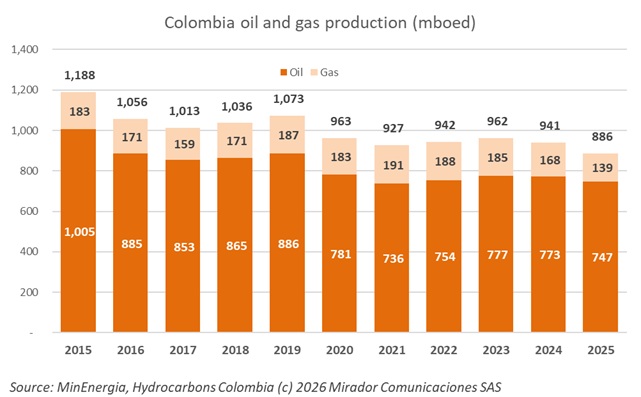

Colombia’s petroleum sector suffered significant production declines in 2025, costing the economy approximately US$660M (CoP$2.3T)—equivalent to nearly 30% of the recently declared economic emergency value—according to data from the Colombian Chamber of Petroleum, Gas and Energy (Campetrol).