Colombia’s military intelligence says it has uncovered evidence that the Farc have been repopulating deserted rural area in Meta and Caquetá by placing indigenous groups in the area, a practice that goes back two years.

Last week we published some harsh comments for the oil industry from former Casanare Governor Jorge Prieto, who said the region would be better off without being the home to a bulk of the country’s oil production. We thought we’d share the list of his colleagues, who we believe have done more to stain the department than anyone else.

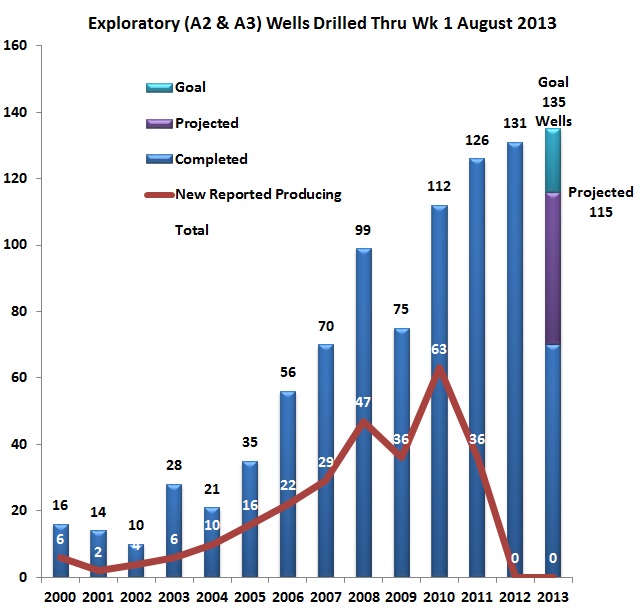

Despite running short of 2013 goals for exploration wells the president of the National Hydrocarbons Agency (ANH) Germán Arce said that the government has decided not to start off shore exploration activities in the San Andrés islands.

Colombian senator Alexander López has called for a public forum this week to analyze seismic exploration conducted by oil companies near water sources, which he alleges are causing grave damage to the environment in Casanare, Meta and Arauca.

The primary problem is that at the main routes out of the Llanos and the Upper Magdalena Valley basin to Barrancabermeja and the Atlantic coast via Bogotá remain blocked. See the complete list of relevant blockages.

Our estimate of the average operating cost per barrel (based on realized oil price minus netback) has fallen for the last two quarters, having demonstrated a long term uptrend over the previous four years.