Colombia’s ministry of Mines and Energy (MinMinas) is preparing rules to deregulate transport rates for new oil pipelines in order to promote more construction in areas with new production.

The Casanare Administrative Tribunal has approved a formal request from the mayor of Tauramena to hold a constitutional popular vote, essentially a public referendum, in which the community can support or reject the development of oil productions in the municipality.

That is the conclusion of an Invermer Gallup poll done for national business magazine Dinero, published in a recent issue. The graph shows selected items from the article.

Monterrey has seen a repeat of blockades and community complaints about the oil industry, and now the municipality is forming a committee with local businesses owners to get their voices heard. Is this just a money or attention grab, or are there legitimate claims?

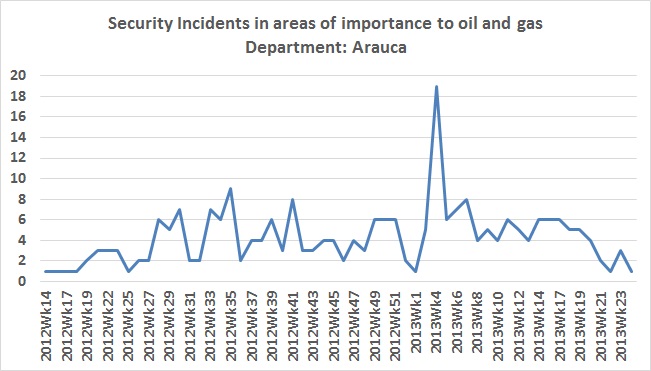

Law enforcement and officials from the Arauca Department held an extraordinary meeting of the region’s security council to analyze the wave of terrorist activity which has fell upon the department.

Colombia’s Energy & Gas Regulation Commission (CREG) has started the process to contract an administrator of the natural gas market, part of its long term wide reaching evolution of how the gas market is regulated.