The Ministry of Mines and Energy (MinMinas) says that it is looking to achieve greater stability in the final price of fuel and issued a list of objectives for talks with the transportation sector. But it says the changes must be gradual and linked to market prices.

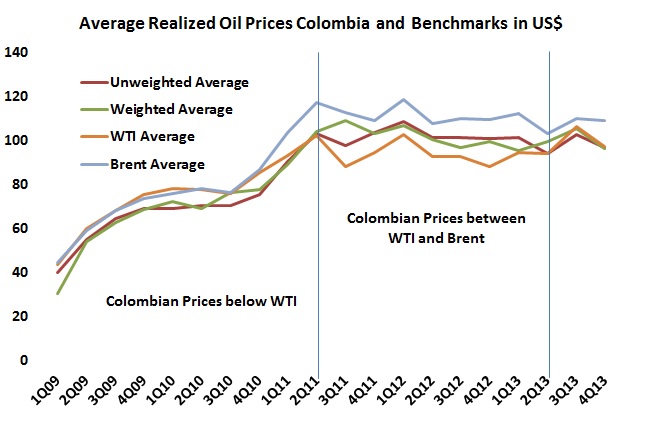

The gap between WTI and Brent opened in late 2010 and from mid-2011 to mid-2013 average Colombian realized oil prices moved in the gap. The gap has closed somewhat in the past few quarters but, for unrelated reasons, average Colombian realized oil prices have moved to or below WTI.

The United States’ shale gas revolution has awakened in other countries around the world the desire to repeat it, and the United Kingdom is one of the front-runners.

After receiving the signature of the Ministry of Mines and Energy Amylkar Acosta, the National Hydrocarbons Agency has published conditions and rules for E&P contracts involving unconventional resources.

This month we start with an interview with Barry Larson, COO of Parex and Lee DiStephano, Parex’s leader in Colombia. They give us a clear-eyed view of the challenges but the overall tone is positive.

After widespread coverage of the drought in Casanare paired with accusations that oil production is causing it, the USO has come out and said that its work with the local community in Arauca could prevent the same tragedy from happening there as well.