While Caribbean offshore blocks have received attention and been the site of recent discoveries, Pacific blocks have failed to gain the same interest and results. Now the National Hydrocarbons Agency (ANH) is looking to hold a competitive process in 2016 to find operators.

The National Hydrocarbons Agency (ANH) is preparing another set of regulatory changes, Agreement 05, which builds on past adjustments designed to make the sector more flexible in the new price scenario. This implements the change to directly assign blocks and could also include even more benefits for offshore contracts.

Led by the Casanare Chamber of Commerce (CCC), 12 business leaders from the local Oil & Gas Services Cluster participated in a trade mission to the United States to explore new markets and make business ties in hopes of stimulating their business.

In early 2013, Naturgas’ Eduardo Pizano and the ANDI’s then VP of Mining, Oil and Energy, Santiago Angel Urdinola staged a very public battle over whether Colombia had or did not have sufficient gas reserves to last into the next decade.

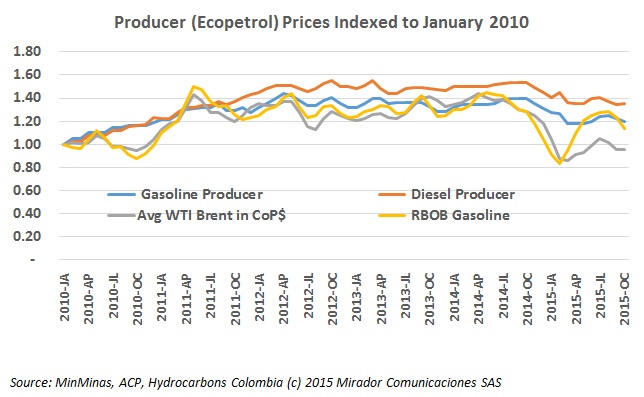

MinMinas announced gasoline and diesel prices this past week and as expected they went down. Also as expected, the truckers association and other groups thought they should have gone down further.

The Ministry of Mines and Energy (MinMinas) announced a decree that formalizes a move to make tax free zones for offshore production blocks, and also announced tax benefits for renewable energy.