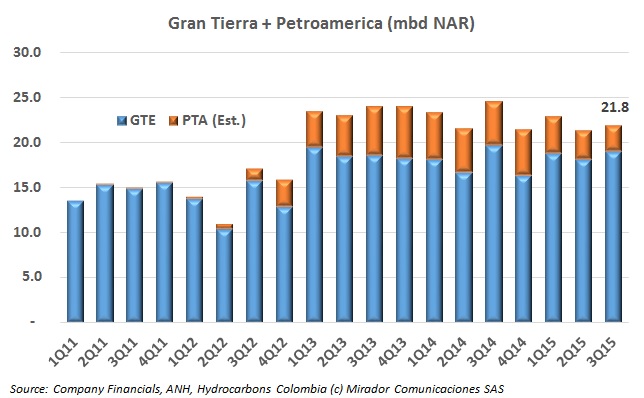

Gran Tierra Energy (TSX:GTE) says that it has entered into an agreement to acquire Petroamerica (TSX Venture:PTA), its first major move since new management took charge earlier this year, and a bid to consolidate its operation in Putumayo.

During a hearing to release the results of a joint sustainable project between the industry and community in Aguazul, Casanare the Vice Minister of the Interior Carlos Ferro Solanilla praised the efforts and results of both the community and hydrocarbons sector.

The oil industry offered its support for road work in Casanare, meanwhile the community in Puerto Gaitán calls for more social contributions and hiring from a local operator. These and other stories on Corporate Social Responsibility (CSR) in our periodic summary.

The National Planning Department highlighted the importance of royalty resources for the post-conflict era, and has outlined changes being made to make their use more efficient.

Editor’s Note: Jaime Checa is one of Colombia’s most respected geophysicists. When he speaks the industry listens. Here he reflects on the sorry state of onshore seismic in 2015, looking beyond the easy excuse of low oil prices.

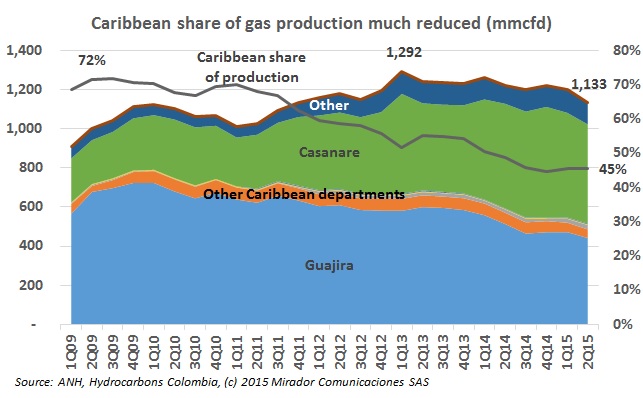

The arrival of El Niño has added a whole new dynamic to an ongoing debate raging along the Caribbean coast over the price of natural gas, as questions on the long term rates and short term supply alike fill the press.