We extended our quarterly analysis of Colombia Committed stocks from December 31, 2015 to January 20, 2016 so we could capture any significant movement due to the deeper slide in oil prices so far this year as well as Pacific E&P’s (TSX:PRE) roller coaster this month.

The president of the World Bank Jim Yong Kim said in a seminar held in the presidential palace that Colombia is the best positioned oil producer in the world to successfully deal with the challenges facing the oil industry today.

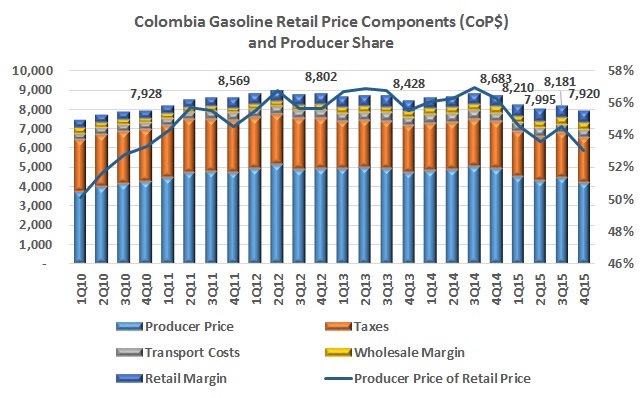

Senate President Luis Fernando Velasco has again called on the government to lower prices and accept a court ruling from December 2015 which deemed a fuel price stabilization tax from the last tax reform was not properly vetted. He says it would lower the fuel prices by CoP$1000 (US$0.30).

I have been back from holidays for less than two weeks; we resumed normal HCC publishing on the 11th of January.

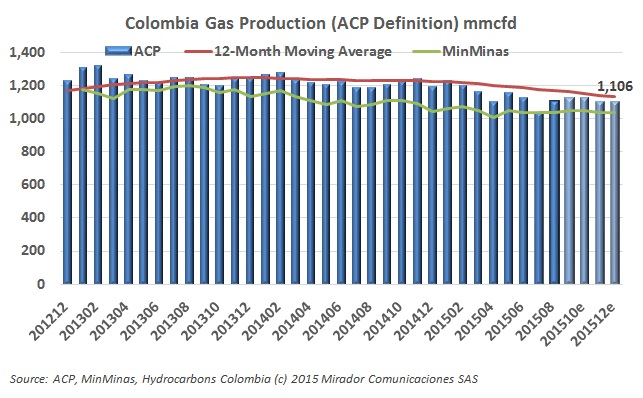

The December MinMinas ‘accentuate the positive’ production press release only mentioned the slight month-over-month increase in December gas production, failing to mention that 2015 finished 5.6% below 2014. Or that, as the graph shows, the trend is decidedly negative.

President Juan Manuel Santos paid a visit to the Caribbean coast and addressed energy costs and supply for the region, which have been creating a stir in national politics. To better address the opportunities and needs, Santos has prepared a ‘road map’ which will lead the way to change.