Ecuador announced plans to increase tariffs for transporting Colombian crude oil through its OCP pipeline, escalating commercial tensions between the neighboring Andean nations. E&Ps operating in the Putumayo use the OCP to get their crude to export.

Martín Fernando Ravelo assumed the presidency of Colombia’s Unión Sindical Obrera (USO), the country’s largest petroleum workers union, replacing César Loza who was elected to represent workers on Ecopetrol’s board of directors.

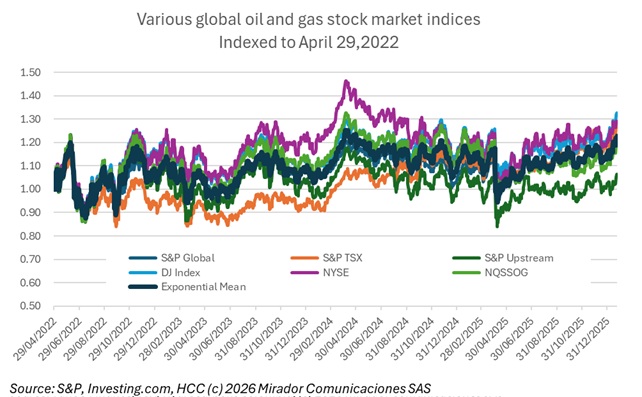

A new year and we thought we should do an update / upgrade to our index of Colombia-focused publicly listed oil and gas companies.

Colombia’s dollar has weakened to around CoP$3,650, its lowest level since President Gustavo Petro took office, but market analysts warn the exchange rate is artificial and disconnected from economic fundamentals.

Ecopetrol called an extraordinary shareholders assembly for February 5, 2026 at 8:00 AM to elect nine board members for terms extending through 2029, following the departures of Mónica de Greiff and Guillermo García Realpe. The completed slate features historic worker representation alongside technical expertise spanning the energy sector.

Chevron announced plans to invest over US$20M during the next five years to improve operational capacity and guarantee fuel supply in Colombia, following its 2020 exit from natural gas exploration and production to focus on becoming a leading fuel and lubricant provider.