Thursday, February 12th, 2026

The Administrative Court of Cundinamarca has admitted a public interest lawsuit against Ecopetrol and the Ministry of Finance aimed at blocking any potential sale of the state oil company’s Permian Basin assets in the United States, Valora Analitik reported on January 28.

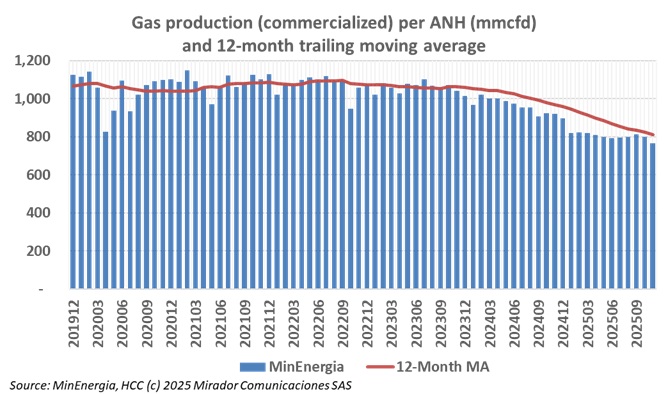

Colombia’s natural gas production averaged 1,265 million cubic feet daily between January and November 2025, representing an 11.7% decline compared to the same period in 2024.

Colombia has identified 14 regasification projects to address its natural gas deficit, spanning both Caribbean and Pacific regions.

Naturgas president Luz Stella Murgas warned that any disruption to operations at the Sociedad Portuaria El Cayao (Spec) regasification plant would jeopardize Colombia’s electricity supply, responding to President Gustavo Petro’s recent order to recover the facility’s property over alleged monopoly concerns.

Colombia’s Attorney General announced February 9 it will file formal charges against Ecopetrol president Ricardo Roa on two separate cases, one stemming from his role as campaign manager for Gustavo Petro’s 2022 presidential bid. The charges mark an escalation from administrative sanctions to criminal proceedings that could reshape leadership at Colombia’s largest company.

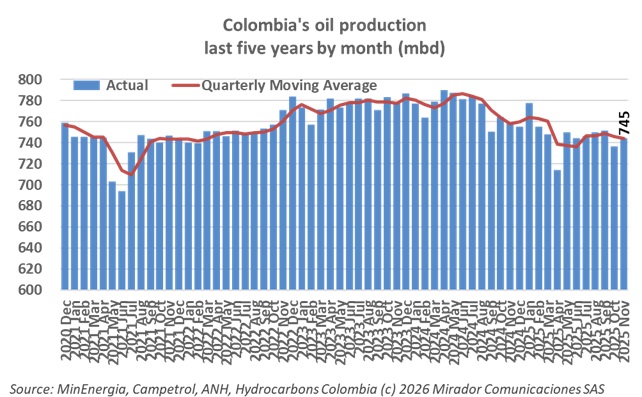

Colombia’s oil production declined 3.6% year-over-year through November 2025, averaging 744,645 barrels per day compared to 774,180 bpd in the same period of 2024, according to the ANH.

Transportadora de Gas Internacional’s (TGI) regasification plant in La Guajira will be operational by early 2027.