The government had announced the possibility of selling 8.5% of Ecopetrol’s (NYSE:EC) shares. The Association of Financial Institutions (ANIF) has plans for the revenue this might generate.

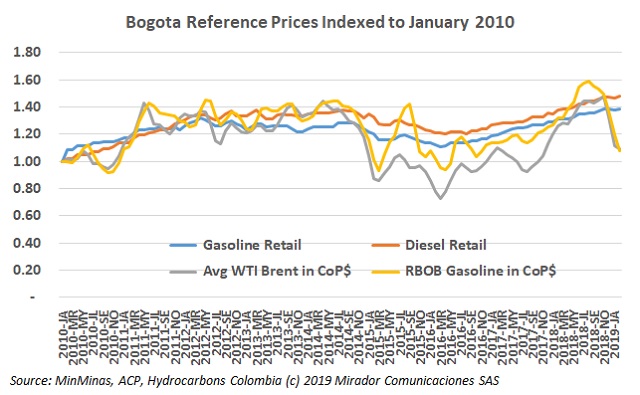

Fuel prices have generated much discussions and controversy in Colombia because of the formula to calculate them and their included taxes, among other issues. The Constitutional Court ruled on one of the components of the prices and the Ministry of Mines and Energy (MinMinas) announced an examination of the formula.

Authorities confirmed that thanks to the General System of Royalties (SGR), the regions were able to receive important resources to develop social investment projects. These and other stories in our periodic Royalties summary.

The Ministry of Mines and Energy (MinMinas) announced a new increase in fuel prices for February 2019. The Colombian Federation of Cargo and Logistics Transporters (Colfecar), commented on this measure.

The Colombian Association of Petroleum Engineers (Acipet) reported that the current president of its Board of Directors, engineer Julio César Vera, is stepping down.

The National Environmental Licenses Agency (ANLA) announced progress in the risk management plan of the Caño Limon-Coveñas pipeline (CCL). The entity pointed out that local authorities are helping in this process.