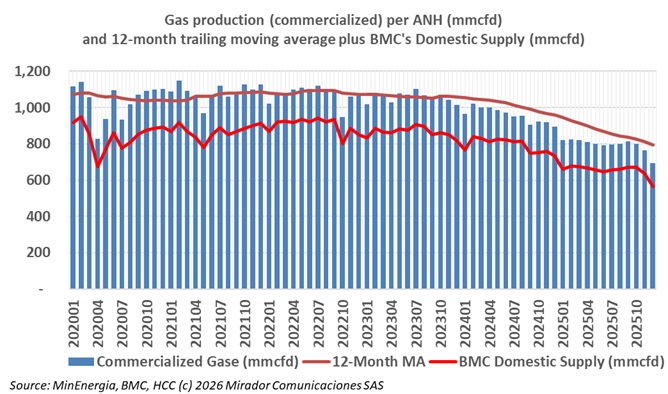

The ANH reports that commercialized natural gas production in December 2025 stood at 692.91 million cubic feet per day (mcfd). This monthly variation does not compromise the country’s energy security nor is it due to public policy decisions by the national government.

Financiera de Desarrollo Nacional (FDN) and BTG Pactual announced financial close for Ecopetrol’s Regasificadora del Pacífico project designed to import natural gas through Buenaventura.

Energy Minister Edwin Palma announced Santander’s largest historical natural gas expansion with CoP$51.675 billion investment across 15 projects delivering natural gas, liquefied petroleum gas networks, and eco-efficient cooking solutions to 19,246 households, particularly benefiting women who traditionally perform cooking tasks.

Córdoba Governor Erasmo Zuleta Bechara requested national government authorization to temporarily implement the Works for Taxes mechanism in flood-affected municipalities, announcing he has advanced negotiations with businesspeople willing to contribute through this initiative.

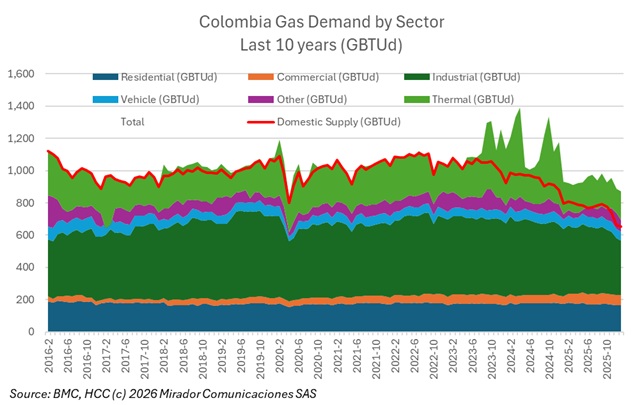

Natural gas market manager BMC published its January report and updated its online databases. Both demand and supply continue to decline.

SierraCol Energy reported full-year 2025 share before royalties (SBR) production averaged 42.0 mboed, down 6% year-over-year, primarily due to restricted pipeline availability in the Caño Limón area during second quarter 2025, partially offset by additional volumes from the Caracara field integrated during second half 2024.