President Gustavo Petro considers selling Ecopetrol’s Permian Basin assets essential for the company’s financial sustainability, but experts strongly disagree, viewing the move as both unviable and harmful to the stock.

The Ministry of Mines and Energy is working on a comprehensive update of the institutional framework to guarantee liquid fuel supply in Colombia. The initiative will be built on two main pillars: strengthening the legal and operational framework for fuel imports, and creating a Liquid Fuels Manager.

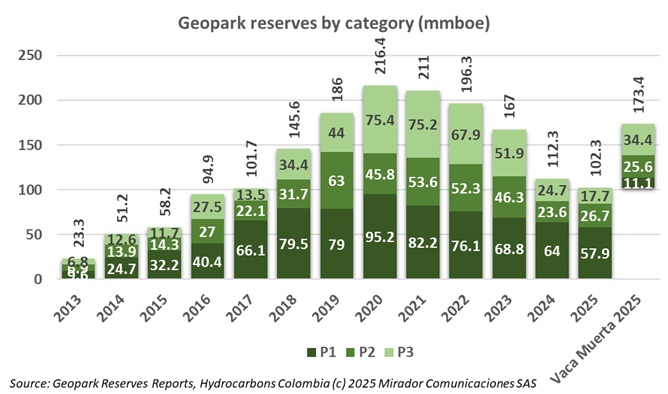

Anticipating the time of year when reserves reports usually appear, Geopark published a press release and detailed reserve report reflecting its participation in the Vaca Muerta.

Colombia’s Energy and Gas Regulatory Commission (CREG) issued two key resolutions in late November 2025 to address the country’s natural gas supply constraints and facilitate imported gas contracting. The measures aim to eliminate barriers that limit or discourage imported gas procurement while enabling short-term transportation solutions.

Ecopetrol’s Board of Directors experienced significant changes in late November 2025, marking the second major departure in recent months and reshaping the leadership structure of Colombia’s state oil company.

The Colombian Association of Geologists and Geophysicists of Energy (ACGGP) presented a comprehensive public policy proposal aimed at strengthening the country’s energy security through scientific evidence, increased exploration, enhanced state technical capacity, and improved territorial engagement models.