Ecopetrol (NYSE: EC) launched a new petrochemical export system targeting Latin America and the Caribbean, marking a significant step toward reducing its carbon footprint and eliminating intermediaries in its supply chain.

In late 2019, Ecopetrol (NYSE: EC) ventured into the fracking business in the US through a partnership with Occidental Petroleum (OXY).

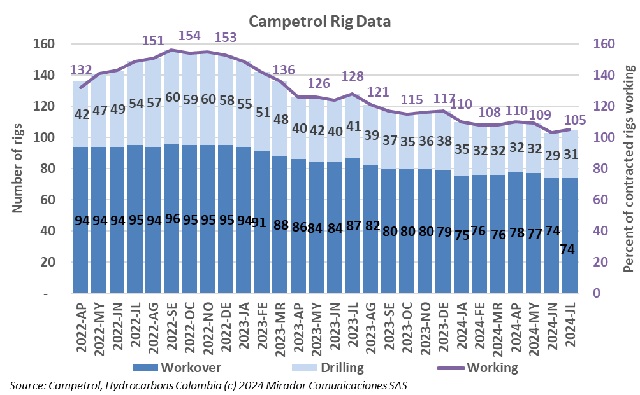

The Colombian Chamber of Goods and Services (Campetrol) reported rig information for July 2024.

Cenit announced that it has activated the Emergency and Contingency Plan (PEC) for the Coveñas Caño Limón (CCL) and Bicentenario (OBC) pipelines.

Alejandro Martínez, President of Gasnova, called on the Petro administration to not defunding subsidies for propane used by lower-income households.

A resignation letter highlights the growing influence of Colombian President Gustavo Petro over the Ecopetrol Board of Directors, raising concerns about the independence of the country’s largest company.