GasSantiago Urdinola must wish he had never got out of bed the day he told a public audience that the country could face rationing as early as 2019. Since then fire and brimstone have rained down from the office of the natural gas industry association Naturgas.

Business magazine Dinero reported that the Dian penalized the oil company CECSA, a Canacol subsidiary, by closing of the CECSA offices from April 26 until April 29. The cause was an error in CECSA’s crude oil sales invoices. The error happened in 2008 and there was no tax evasion, which is why the Dian did not impose any fines on the company.

This the longer version of the ANDIs study on gas supply. From an ANDI press release, translated and with commentary by Hydrocarbons Colombia.

Oil gets much of the attention but from a domestic politics point of view, gas is perhaps more important. The government has been pushing development of gas as a substitute for dirtier fuels and as part of an integrated strategy for electrical generation. From a MinMinas press release, translated and with commentary by Hydrocarbons Colombia.

This week the forum on political participation organized by the United Nations Office on Colombia and the Colombian National University Think Tank for Peace took place. The purpose of the forum was to create a space for participation in which citizens were invited to express their views on the peace process.

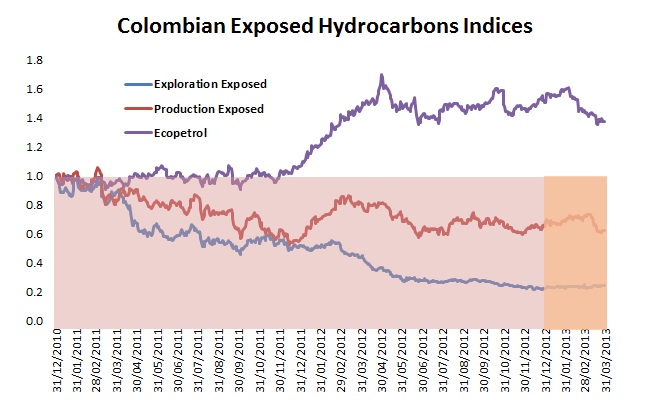

Here we define a new set of stock price indices – Exploration Exposed and Production Exposed – where we exclude companies for which Colombia is only a minor part of their business (like Oxy or Petrobras).