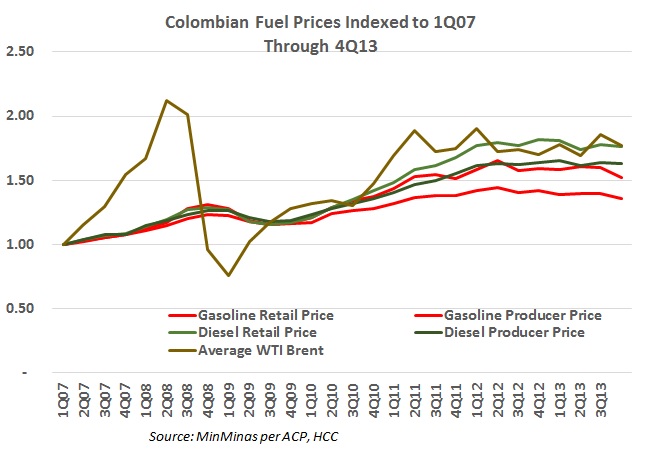

The Minister of Mines and Energy Amylkar Acosta has ruled out a new price freeze on diesel while transportation associations and fuel retailers repeat demands that the cost must drop.

A proposal from the National Infrastructure Agency (ANI) to route tanker-trucks carrying crude from the Rubiales fields through the municipalities of Maní and Aguazul has a number of local officials in arms over the possible ramification of the increased tanker traffic.

The Caño Limon –Coveñas Pipeline, an asset of Ecopetrol (NYSE:EC), announced the awarding of the maintenance contract to a new operator, and while some in the local press are interested in the opportunities this may bring, others have rejected it as a change of façade and nothing else.

The USO and CB&I (NYSE:CBI), the contractor in charge of construction of the expansion of the Cartagena Refinery (Reficar) sat down along with national authorities and Ecoperol (NYSE:EC) representatives to follow up on a collective labor agreement reached last year.

Colombia’s oil and gas sector led the market with an average salary increase of 5,6% in 2013, well above accumulated inflation for the year of 1.9%, meaning workers in the industry increased their buying power last year.

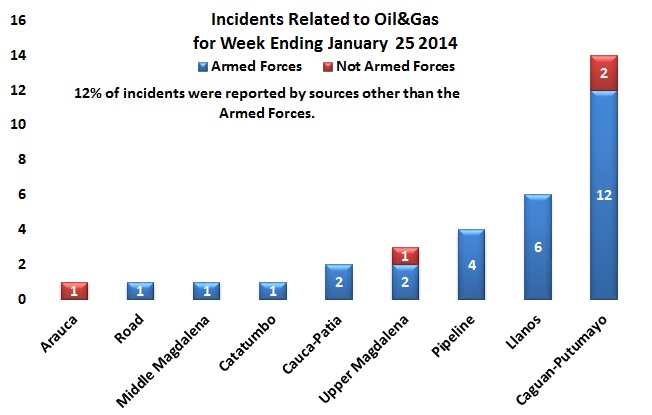

Incidents near areas of interest to the oil and gas industry were down from last week’s recent peak at 33 but right at recent and long-term averages. Both last week and this week may be underestimated for reasons explained below. Non-Armed Forces-reported incidents were above average in absolute terms but below average as a percentage of the total. This is our indicator of increased guerrilla-initiated activity. Our 4-week Moving Average incident count was up at 33.0 and the 52 week average was actually down slightly at 31.9 incidents per week.