ProductionE&P contracts have been available since the establishment of the National Hydrocarbons Agency (ANH). They were designed to attract other investors / E&P companies to increase reserves and production.

Investments to meet emissions standards set by the Ministry of Environment and Sustainable development have amounted to a CoP52B (US$26.4M) investment into Ecopetrol’s refinery business, only considering the Barrancabermeja Refinery.

As the date to announce fixed fuel prices for April approaches, pressure has increased on the national government to lower fuel prices, while the Minister of Mines and Energy Amylkar Acosta insists that the public should not be expecting further cuts.

School is back in session for 2014 providing an opportunity for oil producers to give school supplies to communities in their area of influence, while another program looks to encourage environmental protection at the village committee level. These and other Corporate Social Responsibility (CSR) stories.

Stories this week involving the public roadways and the oil industry include talks between local leaders and Equion, an Ecopetrol program to pave roads in Arauca, restrictions in Caquetá and more.

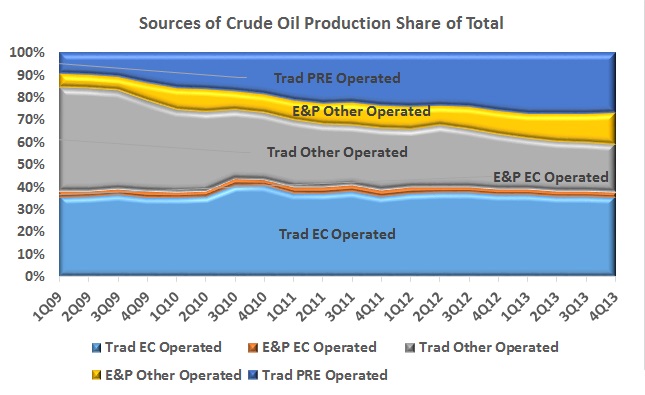

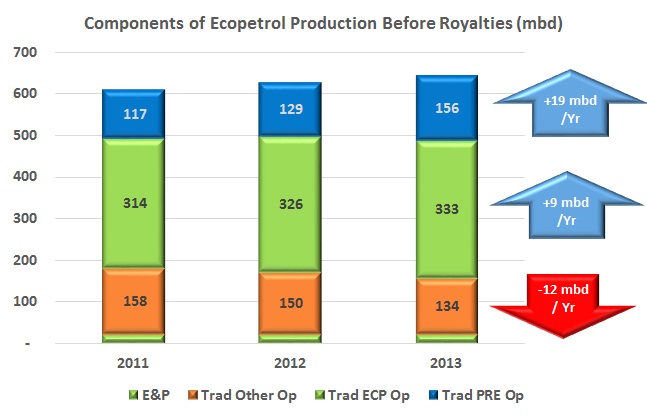

As Ecopetrol (NYSE:EC) shareholders go into today’s Annual Meeting they will probably be concerned about the dividend. They may be calmer than they might have been about the share price since it is up nearly US$5 from late February although still below where it closed at the end of 2013. They might complain about the refinery business. We think they should ask questions about growth.