A recent roundtable of the Oil & Gas Cluster that the Casanare Chamber of Commerce ended with the president of the Colombian Chamber of Oil Goods & Services (Campetrol) Rubén Darío Lizarralde concluding it is time to stop the ‘mafias’ that have taken hold of oil company and community relations.

Ecopetrol (NYSE:EC) says that it has started testing the first units of the Cartegena Refinery (Reficar), and that full operations will start in March 2016.

President Santos has launched a publicity campaign to promote the importance of the peace process and that the end of war brings benefits to the entire country, not just the war-zones as more details emerge on how the transition process would work.

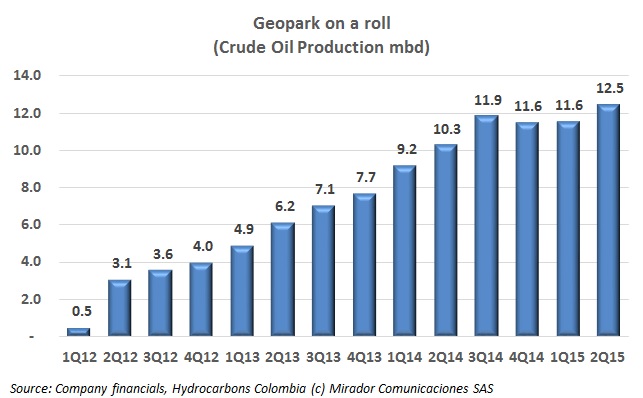

Geopark (NYSE:GPRK) saw a small drop in its consolidated production (including operations in Chile and Brazil) and financial results dragged down by the fall in oil prices, yielding a loss. But the firm has reopened suspended operations in Colombia after a cost restructuring, and added new production for a 22% increase.

Colombian authorities should be paying close attention to not just the results of the first Mexico Round, but how the rest of the process plays out. It clearly demonstrates that contract conditions and geology weigh just as heavily as state take when deciding whether to bid or not, says a business publication.

After a considerable amount of debate on how to set natural prices and allow the different parts of the supply chain to agree to rates, the Energy and Gas Regulation Commission (CREG) has opted for direct negotiation.